13th NTHU-UNSW-SMU Symposium on Sustainable Finance and Economics

13 February 2026

This edition of the symposium featured keynote speaker Professor Lubos Pastor (University of Chicago), who discussed “carbon burden”, the present value of the social costs of a firm’s current and future carbon emissions and explored whether sustainable finance can help ease this burden.

15th Annual SKBI Conference: When AI, Finance, and Web3 meet

27 November 2025

SKBI proudly helms Day 1 of the inaugural SMU Web3 Week, kicking off the week-long series of presentations, talks, forums, and networking opportunities exploring the intersections of AI, finance, computer science, and art. This event is co-organised with SMU’s School of Computing and Information Systems (SCIS).

12th NTHU-UNSW-SMU Symposium on Sustainable Finance and Economics

21 November 2025

This quarterly virtual symposium that focuses on finance and economics research issues related to sustainability, climate change, corporate social responsibility, environmental protection, and social welfare and growth. Keynote speaker and Nobel Laureate, Philippe Aghion (Collège de France & LSE) presented on the topic "Energy Transition and Green Innovation".

11th NTHU-UNSW-SMU Symposium on Sustainable Finance and Economics

5 September 2025

This quarterly virtual symposium that focuses on finance and economics research issues related to sustainability, climate change, corporate social responsibility, environmental protection, and social welfare and growth. Keynote speaker Henri Servaes (London Business School) presented on the topic "Do Consumers Care about ESG: Evidence from Barcode Level Sales" and the session was moderated by Hao Liang (SMU).

Workshop: AI and Web3 for the Future Financial Industry

4 September 2025

This workshop held during SCIS Industry day featured presentations from both academia and industry, including speakers from SMU’s School of Computing and Information Systems (SCIS), the Sim Kee Boon Institute for Financial Economics (SKBI), and leading financial institutions. The session is designed for industry professionals, partner organisations, and faculty researchers, providing a platform to share insights and discuss the evolving role of AI and Web3 in shaping the financial sector.

Panel: Making Thoughtful Financial Decisions to Thrive in an Uncertain World

22 August 2025

In today's fast-paced world, being financially savvy isn't just a nice-to-have - it's a necessary life skill. This panel discussion features distinguished speakers Ms. Angela Teng (The Simple Sum), Prof. Aurobindo Ghosh (SMU) and Mr. Chris Teo (Temasek) as they dish out real-world personal finance tips you can use to thrive in this landscape.

Asian Financial Leaders Programme: Graduation Dinner (Class of 2024/2025)

17 July 2025

Business leaders from the graduating cohort celebrated their graduation from the prestigious Asian Financial Leaders Programme (AFLP), with AFLP alumni and Guest-of-Honour, Mr Leong Sing Chiong (Deputy Managing Director at Monetary Authority of Singapore).

ABFER 12th Annual Conference

19-22 May 2025

The 'Tech, Digital Markets and AI' segment of the conference was jointly organised with Google, SEA and SKBI at this year's Asian Bureau of Finance and Economic Research (ABFER). In addition to presenting his paper, SKBI Director, Hong Zhang, also chaired several sessions within this segment.

2025 Five-Star Asia Pacific Workshop in Finance

16-17 May 2025

The Five-Star Asia Pacific Workshop in Finance aims to provide an open platform to bring together scholars from top research institutions in the Asia Pacific region. It covers four topics - (1) The Nexus of Immigration and Entrepreneurs, (2) Advances in Green Finance and AI, (3) Insights Into Informed and Benchmark-driven Trading, and (4) The Impact of Regulation and Financial Conditions.

10th NTHU-UNSW-SMU Symposium on Sustainable Finance and Economics

9 May 2025

This is the first year that SMU via SKBI has joined National Tsing Hua University (NTHU) and the University of New South Wales (UNSW Sydney) as a co-host of the Symposium on Sustainable Finance and Economics. Ralf Martin (Imperial College / International Finance Corporation) delivered a keynote on opportunities in the clean transition, exploring how investment and innovation in new energy technologies have varying impacts across different economies.

A Bridge over Troubled Waters: Youth in Uncertainty

5 May 2025

This event, co-organised with the Indian High Commission, features author and motivational speaker, Mr Shiv Khera, who has inspired and encouraged individuals to realize their true potential and has taken his dynamic personal messages to opposite sides of the globe, from the U.S. to Singapore. His 40 years of research and understanding has put millions on the path of growth and fulfilment. This event is co-sponsored by the SMU Inclusive and Immersive Experiential Learning (I2XL) Programme, an initiative of the Sim Kee Boon Institute for Financial Economics.

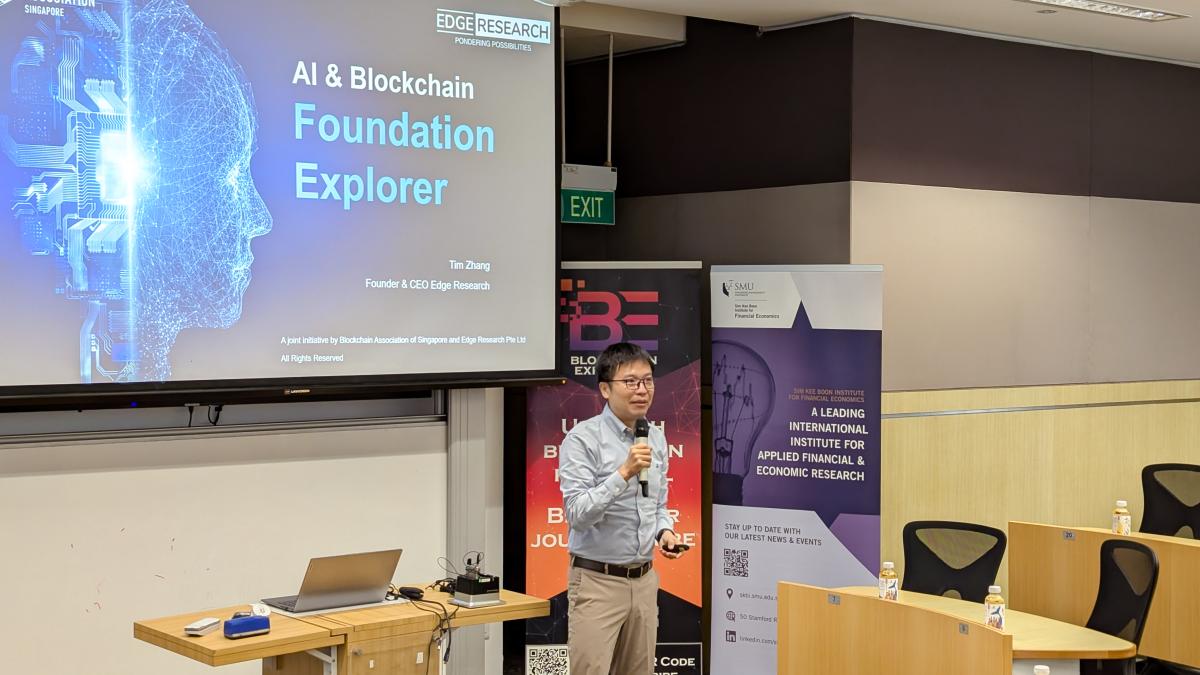

SKBI Seminar Series: AI and Blockchain Foundation Explorer

4 April 2025

This seminar, co-organised with the Singapore Blockchain Association and featuring guest speaker Tim Zhang from Edge Research, equips participants with foundational knowledge of Artificial Intelligence (AI) and blockchain technology, highlighting their transformative potential across industries. Attendees will explore core principles and practical applications of AI and blockchain—gaining insights into how these technologies are driving innovation in today’s digital economy.

SKBI Industry Workshop: Human or Artificial Intelligence – Perspectives of a Global Quantitative Investment Powerhouse

19 November 2024

This SKBI Industry Workshop features Co-Founder, David Siegal, and CEO, Kenny Lam from Two Sigma, one of world’s largest quantitative hedge funds applying advanced technologies to its investment management business. This workshop gives participants an insight on how advanced technologies—including AI and machine learning—have been deployed, and how human components will evolve. It will also address risks, policy shifts and macro headwinds in the region and the implications it has for advancing technological platforms amidst all of this.

14th Annual SKBI Conference on Transition Finance

5 November 2024

Bringing together leading thinkers, researchers, and practitioners from the fields of climate and nature science, sustainable finance, and technology, this in-person conference will explore the critical elements of a credible transition for Asia. Jointly organised by SKBI & SGFC, this conference is curated to foster constructive dialogue across the key thematic areas, "Transition Finance in the Asian Context", "Blended Finance – De-risking versus Concessionality" and "Digital Transition – How AI Assists Digital Transition".

Asian Financial Leaders Programme: Graduation Ceremony (Class of 2023/2024)

2 October 2024

Over 40 business leaders celebrated their graduation from the prestigious Asian Financial Leaders Programme (AFLP). Minister of State for the Ministry of Culture, Community and Youth, Mr Alvin Tan, graced the event as the Guest-of-Honour.

Summer Study Group, organised by SKBI

July-August 2024

Over the course of the summer, SKBI organised the Summer Study Group to give PhD students a platform to discuss papers, receive feedback on their work and learn from each other as well as from faculty members. Papers discussed covered topics from FinTech, Behaviour Finance, Machine Learning, Product & Labour Market Competition and more.

SKBI Seminar in Financial Literacy: Introduction to Private Credit

16 August 2024

Private credit is a rapidly growing asset class gaining market share as investors seek a defensive allocation and to diversify away from public market volatility while delivering outstanding risk-adjusted returns. Hear from Chris Wyke, Joint CEO of one of Australia's leading private credit asset managers MA Financial Group, as he explores the fundamentals of the asset class, its key benefits, the diverse market segments it encompasses and why private credit is attractive in an era of higher interest rates.

SKBI Industry Workshop: AI Meets Finance - A computer science & industry perspective

14 June 2024

The panel aims to explore the burgeoning intersection of AI and Finance, featuring insights from esteemed computer science experts and industry veterans. Panellists: Benedict Lim (AI Project Management Lead, Investment Insights Department, GIC), David Cui (Former MD and Head of China Equity Strategy, Bank of America Merrill Lynch), Feida Zhu (Associate Professor of Computer Science, SMU School of Computing and Information Systems. Moderator: Hong Zhang (Director, SKBI)

SKBI Seminar Series: Expected Returns and Large Language Models

12 June 2024

SKBI Distinguished Visiting Faculty, Prof Dacheng Xiu, shares from his working paper titled "Expected Returns and Large Language Models.

Abstract: The authors leverage state-of-the-art large language models (LLMs) such as ChatGPT and LLAMA to extract contextualized representations of news text for predicting stock returns. Their results show that prices respond slowly to news reports indicative of market inefficiencies and limits-to-arbitrage. Predictions from LLM embeddings significantly improve over leading technical signals (such as past returns) or simpler NLP methods by understanding news text in light of the broader article context. For example, the benefits of LLM-based predictions are especially pronounced in articles where negation or complex narratives are more prominent. The authors present comprehensive evidence of the predictive power of news on market movements in 16 global equity markets and news articles in 13 languages.

2024 Five-Star Asia Pacific Workshop in Finance

17-18 May 2024

The Five-Star Asia Pacific Workshop in Finance aims to provide an open platform to bring together scholars from top research institutions in the Asia Pacific region. It extends the scope of the Five-Star Workshop in Finance in China, which has been organized for 11 years covering 10 leading finance research institutions in China.

Seminar on "Inflation, Cost of Living and other Wicked Problems: What has Policy got to do with it?"

26 April 2024

This session will explore some findings from the latest round of DBS-SKBI Singapore Index (SInDEx) Inflation Expectations Survey (51st edition) and a panel sharing on possible challenges and ways of dealing with the increase in cost of living and personal financial decisions. Using data and analysis, our panellists will shed some light on the instruments of price increases and how we can potentially address these questions as academics, practitioners, policymakers, businesses, and consumers. We would also launch a formal call for problem statements from public and private sectors to address these issues and ongoing challenges related to financial wellbeing and financial inclusion through the FInHack 2024.

- View the event recording & highlights

- Related Article: Singaporeans' Inflation Expectations Trending Down Moderately Amid Global Headwinds

Webinar on AI Research and Applications in the Era of Big Data and "Large" Models

12 March 2024

In this talk, Professor Dejing Dou will first briefly introduce several milestones in the history of artificial intelligence. He will then discuss the new developments in artificial intelligence, particularly in deep learning and large language models, and their applications in big data, combining his research and applications at the University of Oregon, Baidu Research, and Boston Consulting Group. The main topics include (1) cross-disciplinary research in semantic technology and deep learning in health informatics, (2) applications of spatio-temporal big data mining in smart cities and clean energy, (3) the use of federated learning in trustworthy AI and large language models interpretability in deep learning and (4) research in bio-computing the implementation of generative AI and large models in business scenarios.

Seminar on "Machine Learning Retail Investors" (Digital Business Research Peak)

30 November 2023

Join Hong Zhang (SMU Professor of Finance, SKBI Director) for a seminar on the paper “Machine Learning Retail Investors” (coauthored with Pulak Ghosh, Huahao Lu, Jian Zhang). This seminar is organised by the Lee Kong Chian School of Business, in collaboration with the Sim Kee Boon Institute for Financial Economics.

Abstract: This paper employs various machine learning models to analyze the returns for millions of retail investors in India. We observe that the Neural Network outperforms other machine learning and OLS models in uniquely predicting both good and bad out-of-sample performance. Variable gradient analysis further suggests that behavioural biases exert a more significant influence than holding-weighted firm characteristics. Among all predictors, we identify (under) diversification, portfolio turnover, and momentum as the leading factors to influence overall retail returns. Additionally, turnover, the disposition effect, and diversification emerge as the three most important factors in predicting the returns for newly initiated trading.

13th Annual SKBI Conference & 2nd SGFC Conference: Nature Finance Conference 2023

29 November 2023

Nature finance plays a critical role in supporting nature and biodiversity by mobilising funds from both public and private sectors. Increasingly, governments, organisations, and financial institutions are recognising the need to account for nature in their strategies and capital allocation decisions. What roles can public and private investors play in nature financing? What are the challenges and opportunities faced by the financial sector today? This conference explores these critical questions and more!

- View the Event Highlights

- Related Article: Can the market save nature? – Tackling the “glaring research gap” between dollars and data in biodiversity finance for a better future

- Related Article: Shining the “grow light” on Nature Finance

Seminar with Xavier Giroud

28 November 2023

Guest speaker, Prof Xavier Giroud from Columbia Business School, shared from his paper titled, “Managing Resource (Mis)Allocation”.

Graduation Ceremony for the Asian Financial Leaders Programme

24 October 2023

Five cohorts of 128 business leaders celebrated their graduation from the prestigious Asian Financial Leaders Programme (AFLP) on Tuesday, 24 October 2023. Deputy Prime Minister and Coordinating Minister for Economic Policies, Mr Heng Swee Keat, is the Guest-of-Honour. This is the first time the AFLP is holding a graduation dinner since 2019 due to COVID-19 restrictions during the pandemic.

Seminar on "Cost of living and business costs in Singapore"

26 September 2023

Inflation remains a top concern for Singapore’s consumers and businesses. While inflation is finally easing in 2023, consumers and businesses are still feeling the pinch of price increases, with costs likely to be higher than in the past. Join us in this seminar, where we will dissect the differences between inflation and cost of living for consumers, as well as discuss the cost pressures faced by businesses at a time of slower economic growth.

- View the Event Recording & Download Presentation Slides

- Related Article: Flatterning Trend in Inflationary Expectations on Global Cues (48th round of the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey)

International Conference on ESG and Climate Governance

26-28 June 2023

The conference is a global collaboration between the Centre for Climate Engagement and Climate Governance Initiative, based at Hughes Hall, University of Cambridge and Singapore Management University (SMU)’s Sim Kee Boon Institute for Financial Economics with support from the Singapore Green Finance Centre (SGFC). It brings together academic experts, practitioners, and board directors from six continents, across disciplines and industry sectors to address theoretical and practical challenges to climate action across the world by drawing on academic expertise to develop impactful solutions which can be put to practice.

- View the Event Recap & Higlights

- Read the Guest-of Honour keynote by H.E Kateryna Zelenko (Ukranian Ambassador to Singapore)

- View the Event photos

- Related Article: Working towards impactful soultions to the climate crisis

Xi's Third Term and Challenges of Sustainability in China: Politics, Priorities, and Policy

31 May 2023

After consolidating power for the past decade, Xi Jinping secured a precedent-breaking third term as president of the PRC this March, and his proteges now dominate the national and provincial leadership in China’s Party-State. How will Xi’s new team, comprised of many technocratic leaders with strong backgrounds in China’s flagship companies and research institutions, differ from their predecessors in terms of policy priorities? How do their political and professional backgrounds shape the way in which they address the challenges of the country’s economic slowdown, large-scale closure of small private firms, middle-income trap, long-term population decline as well as the everchanging international environment? What does Xi’s call for common prosperity and sustainability, especially clean energy and technological innovation, in China’s next phase of development mean for the foreign business community? At this event, Dr. Cheng Li (Director and Senior Fellow, Brookings Institution’s John L. Thornton China Center) who is an expert on China’s leadership politics and strategic thinking, shares more about China’s domestic governance and foreign policy in the next five years and beyond.

The Money Awareness and Inclusion Awards (MAIAs) 2023

17 May 2023

As knowledge partner of the MAIAs, SKBI is proud to sponsor a new award at this year's ceremony - "The SKBI Prize for Sustainable Financial Literacy". SKBI Director & MAIA Judge, Dave Fernandez highlighted that Sustainable Finance is not a trend that will go away; instead it will eventually widen and change the traditional definition of financial literacy. Even though the field of sustinability in the global finance community is nascent, it is important that the MAIAs start celebrating the increasingly important work being done within the sustinable financial literacy space.

SGFC's Green FinTech and Data Centre Workshop

19 April 2023

What is the current landscape of sustainability awareness, commitment, and performance of data centres owners, investors, and clients in Singapore? What innovative steps have Singaporean data centres taken to enhance its sustainability performance, and to what extent are these steps relevant and sufficiently ambitious to address the environmental concerns of Singapore's growing reliance on tropical data centres? Join us for this 2-hour workshop where these questions will be addressed. You will hear an overview of how “green” is “Green FinTech”, and gain new insights into the growth of data centres in Southeast Asia. There will be opportunities to exchange views on best practices, challenges and application of innovative technology in data centres. This workshop is primarily designed for those working in data centre and related sectors who are interested in ESG implications, decarbonisation and green finance.

Seminar on Analytical Chapters from the IMF World Economic Outlook April 2023

13 April 2023

The three chapters cover:

• the evolution of the natural rate of interest and its impact on monetary and fiscal policies (Presented by: Jean-Marc Natal, Deputy Division Chief at IMF)

• how to durably reduce public debt-to-GDP ratios and explores the impact of different policy instruments (Presented by: Sakai Ando, Economist at IMF)

• how geoeconomic fragmentation reshapes the geography of foreign direct investment and affects the global economy (Presented by: Ashique Habib, Economist at IMF)

Moderated by Leo Krippner, Research Fellow at SKBI.

Insights from COP 27 & COP 15 and its Implications for the Board (CGS)

4 April 2023

The recent COP27 & COP15 resulted in landmark agreements and set targets for the world's collective climate goals. Join us online to hear from esteemed climate & sustainability experts as they distil insights gained from these conferences, as well as what implications the outcome of such conferences has for the board.

- View the video recording.

- Related Article: Future-proofing companies by considering climate strategies

SGFC Climate Finance Academy 2023

28 - 31 March 2023

Delivered across four days, this executive education programme features workshop style discussions; highly impactful, personalized, and immersive lectures; and real case studies developed with our SGFC Partners. The programme is made up of four modules.

Module 1: Introduction to Climate Change Science and Scenarios

Module 2: Climate Risks, Financial Scenarios and Policy

Module 3: Transition Finance, Instruments, and Carbon Markets

Module 4: Investment and Financing Solutions

SGFC's ASEAN Renewables Report Launch Webinar

27 March 2023

Meeting net-zero emission targets requires unprecedented levels of investment and the allocation of capital to clean energy projects globally. This webinar will highlight the key findings on the priorities for public and private stakeholders to ensure a successful clean energy transition. The report seeks to improve transparency and analysis around the risks and barriers for clean energy investments in the ASEAN region, helping to increase the opportunities available to investors.

SGFC's Financing Urban Climate Change Adaptation in Singapore Workshop

17 January 2023

To what extent can cities and investors in finance systems build for climate adaptation innovation in cities? This research question was discussed at the workshop on the topic of ‘Financing Urban Climate Change Adaptation in Singapore’, with key research findings and insights from the white paper, presented by Stella Whittaker (Imperial College) and Phuong Nguyen (SKBI).

ADBI-SMU Conference on Digital Finance and Sustainability

7-9 December 2022

This ADBI-SMU virtual conference, with a focus on Asia, will feature new research on digital finance and its implications for sustainable and inclusive economic growth. Areas of exploration will include the role of digital finance in economic resilience, digital payment systems and economic efficiency, how digital finance can affect environmental sustainability and sectoral productivity, and sustainable digital finance and green fintech-related issues.

Selected papers presented at this conference will be considered for open access publication in a special issue of the journal, Sustainability, co-edited by Dave Fernandez & John Beirne.

12th Annual SKBI Conference & 1st SGFC Regional Conference on Greening Energy Infrastructure

5- 6 December 2022

A 1.5-day conference bringing together academics, policymakers, and industry experts from Singapore and across the region to network and discuss sustainable energy solutions. The conference focuses on four areas of green energy infrastructure around the region (ASEAN, India, and China).

Selected authors will present summaries of policy research papers. Selected industry and policy practitioners will make presentations on learnings from on-the-ground experience and/or offer concrete suggestions/solutions to address certain identified challenges. Finally, a moderated roundtable discussion will seek participation from the wider audience or policymakers and industry participants from across the region.

Asia Pacific Financial Education Institute 2022

17-18 November 2022

The sharp rise in inflation affects every household and highlights the importance of personal financial literacy and education. SMU will host the Asia Pacific Financial Education Institute (APFEI) on 17-18 November which will feature new academic research in this emerging field. The papers will cover topics like Financial Education and Spillover Effects, Retirement Planning Tools, Financial Literacy in Housing Markets, Fintech Nudges including Overspending Messages, Retirement Savings Behaviour in Thailand, and Sustainable Finance Literacy.

This is also the first APFEI conference under the “G53 Financial Literacy and Personal Finance Research Network” – a network which connects top scholars around the world to facilitate the exchange of ideas, promote evidence-based research, and meet the growing urgency for data-driven solutions.

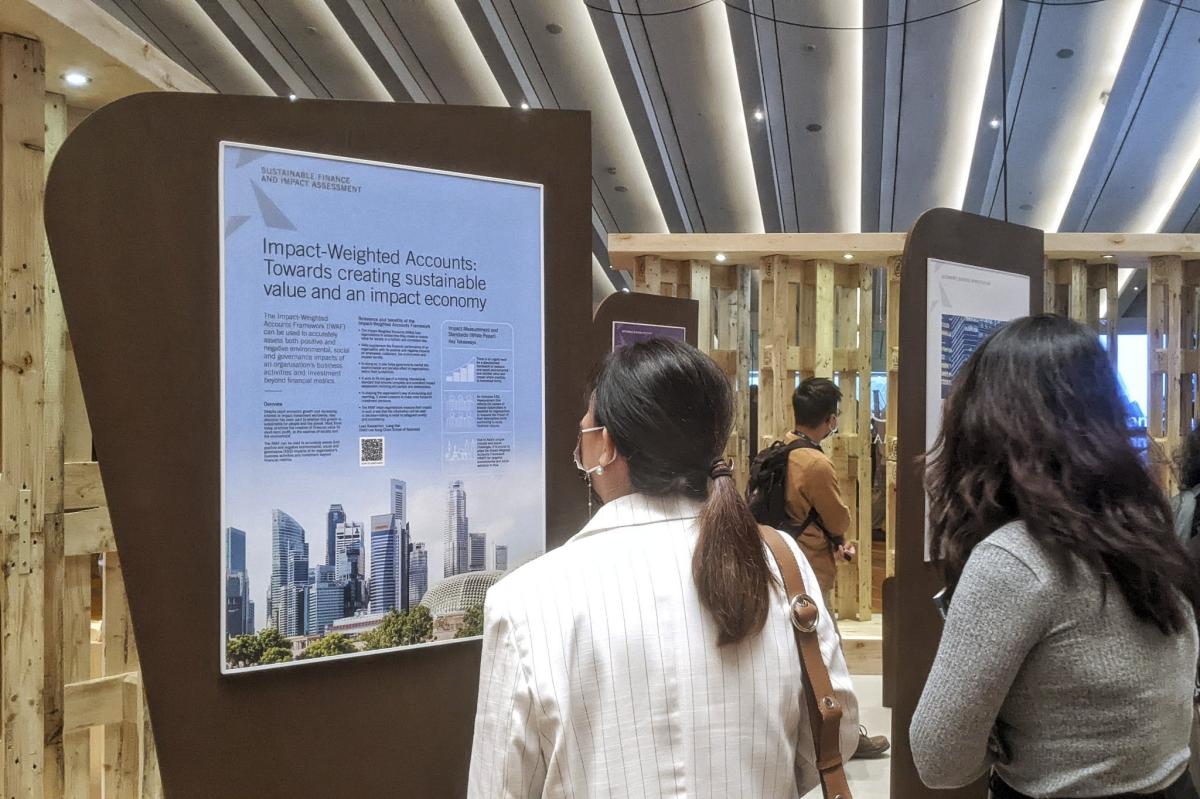

Singapore Fintech Festival

2 - 4 November 2022

The Singapore FinTech Festival (SFF), the world’s most impactful FinTech festival and global platform for the FinTech community, is organised by the Monetary Authority of Singapore, Elevandi, and Constellar, and in collaboration with The Association of Banks in Singapore. The Singapore Green Finance Centre (SGFC) set up a booth at the ESG Fintech Zone to highlight its activities. In addition, SGFC Co-Director, Liang Hao moderated a Fireside Chat titled, “ESG Myth vs Reality”. SKBI Research Fellow, Marc Rakatomalala also participated in the panel “MIT Fintech Initiatives Showcase – The Technology Advantage”.

Launch of the biography "Sim Kee Boon: The Businessman Bureaucrat"

23 September 2022

"Sim Kee Boon: The Businessman Bureaucrat" was launched by Minister for Education and Minister-in-charge of the Public Service, Mr Chan Chun Sing. This biography is more than the story of the pioneer generation leader after which our institute was named. It is a primer of the principles and values that he lived out in his successful career.

Mr Sim successfully bridged public service and the business world throughout his career, and in doing so played an instrumental role in Singapore’s development. His contributions brought great successes to Changi Airport, Tanah Merah Country Club, Keppel Corporation and more. The institute honour the man by continuing his legacy, seeking to improve the society within which it exists.

World Citites Summit

31 July - 3 August 2022

The biennial World Cities Summit (WCS) is an exclusive platform for government leaders and industry experts to address liveable and sustainable city challenges, share integrated urban solutions and forge new partnerships. Singapore Green Finance Centre's research on Impact Measurements & Standards was showcased at SMU's booth at the summit.

The Money Awareness and Inclusion Awards (MAIAs) 2022

31 May 2022

The Money Awareness and Inclusion Awards – the MAIAs – celebrate the increasingly important work being done to help people understand money better, and benefit from the financial system. Hosted by award-winning broadcast journalist Juliette Foster, the inagural award ceremony celebrated the best financial education projects from across the globe, as reviewed by an expert panel of judges including SKBI Director, Dave Fernandez.

Financial Literacy, Inclusion, and Technology (FNCE316)

6 April 2022

Designed to be an experiential learning opportunity, FNCE316 not only teaches undergraduates the basic concepts underlying personal financial literacy, but also how to translate such classroom knowledge into practical solutions for real organizations at the forefront of financial innovation. This is the first module of its kind to be offered at a local university, and is taught by SKBI Director, Prof Dave Fernandez and SKBI Visiting Faculty, Prof Joanne Yoong.

During the final class, students presented their FinTech-focused financial literacy/inclusion project, in the presence of representatives from Project Champions - Endowus, Grab, MoneySense, Sea and SGX Group.

SGFC Climate Risk Academy

29 March - 1 April 2022

This executive education programme is designed to challenge experienced finance leaders to think critically and creatively about climate risks and opportunities. Delivered over four days, the programme features highly impactful, personalised and immersive workshops, group exercises and networking events. The inagural run of this programme was held exclusively for the founding financial partners of the Singapore Green Finance Centre.

ABFER-ABS Industry Outreach Panel: "The Impact of Fin-tech Revolution, Digitalisation and Digital Currencies on the Financial System"

24 February 2022

Digitisation and related innovations, such as Data Analytics, DLT, cryptocurrencies, CBDC (e.g., PBOC) significantly affect financial intermediation and the overall financial eco-system. For example, digitisation revolutionizes payment approaches and credit allocations. Both private sector players and governments are competing and forming new partnerships. With these imminent momentous changes, there will be fundamental shifts in business models, strategic thinking, and our financial system's characteristics. We want to benefit from the experience, insights, and wisdom of industry leaders, policymakers, and academics on these important topics.

Prof Dave Fernandez, SKBI Director, was one of the panelist at this event.

Launch of Women in Sustainability & Environment (WISE)

18 November 2021

WISE Singapore - Women in Sustainability and Environment was launched on 18 November 2021, with Singapore Management University as its knowledge partner. WISE is the first women’s society in Singapore formed to focus concerted gender action towards Singapore’s Green Plan 2030 and United Nations’ Sustainable Development Goals.

At the launch event, the signing of a memorandum of understanding between WISE and SMU was announced. SMU would support WISE in curating knowledge and programmes around sustainability, as well as being involved in the selection criteria for the WISE Sustainability Awards.

Visit the WISE Knowledge Hub curated by us.

Asia Pacific Financial Education Institute 2021

15 - 17 November 2021

Asia Pacific Financial Education Institute (APFEI) is a forum for presentation and discussion of financial education research. It aims to promote excellent work in the field of Financial Education, foster research that can inform policy, and identify effective financial education programs, with a particular emphasis on Asia. The research committee for the APFEI consists of Dave Fernandez (Singapore Management University), Annamaria Lusardi (George Washington University), Alberto Rossi (Georgetown University), and Michael Staten (University of Arizona).

This year, the 11th Annual SKBI Conference is held in partnership with APFEI and spotlights the topic of financial education.

Climate Governance Singapore Launch

28 October 2021

Climate Governance Singapore, the Singapore chapter of the Climate Governance Initiative, was officially launched by Guest-of-Honour, Ms Grace Fu, Minister for Sustainability and the Environment, and attended by World Economic Forum representatives, and boards of directors in Singapore and globally. The Climate Governance Initiative is an expanding network with 15 established chapters globally, including in the UK, US, Canada, France, Australia and Malaysia. These chapters promote the World Economic Forum’s Climate Governance Principles and support effective climate governance in their jurisdictions.

Visit the CGS Knowledge Hub curated by us.

World Expo 2020: Reimagining Business in the Green Economy

6 October 2021

Singapore Business Series is a monthly business-social dialogue that brings researchers, experts, professionals and enterprises together to unlock business opportunities. Thematically aligned to Expo 2020’s thematic weeks, the hybrid events delve into the latest trends, innovation and technology. To address the challenges of climate change, how can businesses make more sustainable decisions, and become part of the solution through driving innovation?

This session features Prof Hao Liang (Management Committee Member, SGFC) and Dr Rajiv B Lall (Professorial Research Fellow, SKBI) among fellow experts and thought leaders in this space. The panel discussion is moderated by Chia Su-Yen, former Head of Government Affairs & Deputy CEO of EuroClear Bank.

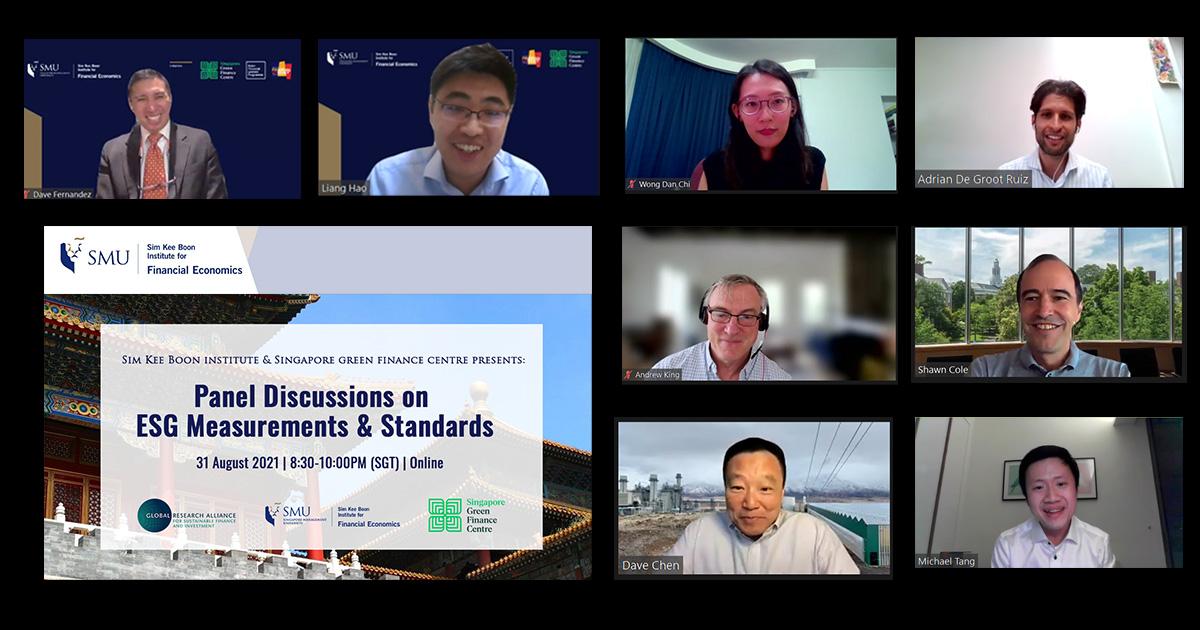

SKBI & SGFC presents: Panel Discussions on ESG Measurements & Standards

31 August 2021

With the growth of sustainable, responsible, and impact (SRI) investing, the measurement and assessment of environmental, social, and governance (ESG) impacts of investment is becoming an imperative issue. Numerous concerns have been raised over the reliability of existing ESG ratings, including the incomparability between different ESG metrics, biases and inconsistencies in rating construction, and low correlations between different ratings. This calls for greater standardization of ESG information disclosure and impact measurement, as well as properly valuing impact, not just in its natural unit but also in monetary terms.

The Sim Kee Boon Institute (SKBI) and Singapore Green Finance Centre (SGFC) presented a live webinar on ESG Measurements and Standards on 31 August 2021. It was held as a side event of the 4th Annual Global Research Alliance for Sustainable Finance & Investment (GRASFI) Conference. The session covered two main topics: (1) divergence and convergence of different ESG ratings, and (2) how measurements can move beyond ratings towards an impact-weighted account.

We were honoured to have the following esteemed speakers at our event.

Industry panel on recent development of impact measurement

- Moderator: Dave Fernandez, Professor of Finance (Practice), SMU; Director, SKBI; Co-Director, SGFC

- Panellists:

- Dave Chen, CEO/Chairman, Equilibrium; Adjunct Professor of Finance, Northwestern University - Kellogg School of Management

- Adrian De Groot Ruiz, Executive Director, Impact Institute

- Wong Dan Chi, Head of ESG Integration, APAC, Schroders; Adjunct Faculty, Singapore Management University

Research and policy panel on measurements and standards

- Moderator: Liang Hao, Associate Professor of Finance, SMU; Lee Kong Chian Fellow, SMU; Management Committee Member of SGFC

- Panellists:

- Andrew King, Questrom Professor in Management, Boston University

- Shawn Cole, John G. McLean Professor of Business Administration, Harvard Business School

- Michael Tang, Head of Listing Policy & Product Admission, Singapore Exchange (SGX)

- Related Article: What lies beneath Impact Measurement in the world of Business

- Related Article: Measuring ESG

Fireside Chat: Transforming Business with Climate Related Data Integration

28 May 2021

Speaking at the final day of the S&P Global's inaugural Sustainable1 conference, SKBI Director, Dave Fernandez, encouraged the audience to embrace the change towards sustainability. Although it might be hard for Asia to achieve net zero targets in the same timeline as OECD countries, this does not mean nothing should be done now. Targets and goals need to be set, even if it is for 2050 or beyond. Everyone can play their part in embracing this change; be it governments who set the targets, Asian firms who can lead in this area or the workforce who can be educated and informed about green issues.

Inflation and Cost of Living in Singapore & Asia

29 April 2021

The Sim Kee Boon Institute (SKBI), together with the IMF - Singapore Regional Training Institute and DBS Bank, presented a live webinar on Inflation and Cost of Living in Singapore and Asia: Post-Pandemic Implications.

This two-part discussion sheds light on these issues from two angles. In part one, the panellists explore the potential for inflation overshooting in developed economies, after below-target-target outcomes for years. In the second part, the panellists look at emerging Asia, where a nascent recovery is underpinned by buoyant exports. Demand-pull inflation looks unlikely given the lack of large stimulus packages, possible delays in vaccination-driven normalization, and a distressed service sector. Still, Asia has traditionally imported inflation through food and energy channels; moreover, tight semiconductor, shipping, and consumer durables markets could boost costs this year. Understanding these opposing drivers affecting cost-of-living and inflation are critical for the design and effectiveness of fiscal and monetary policies.

CNA Leadership Summit 2021: Green Recovery

22 April 2021

Professor Dave Fernandez, Director, Sim Kee Boon Institute for Financial Economics, SMU and Co-Director, Singapore Green Finance Centre, spoke as a panellist at the Channel NewsAsia Leadership Summit 2021, moderated by Ms Dawn Tan, CNA Presenter.

The panelists were:

Prof Dave Fernandez, Director, Sim Kee Boon Institute for Financial Economics, SMU and Co-Director, Singapore Green Finance Centre

Mr Michael Reed, Chief Executive Officer, RBC Singapore and Head of Wealth Management, Southeast Asia RBC Wealth Management

Ms Radish Singh, Financial Crime Compliance Leader, Deloitte Southeast Asia

Dr Bambang Susantono, Vice President, Knowledge Management and Sustainable Development, Asian Development Bank (ADB)

Watch the video recording, part 1.

Watch the video recording, part 2.

ADBI-SKBI Joint Virtual Conference on Digitalization and Sustainable Economic Development

8 - 10 December 2020

The digital economy is improving productivity and competitiveness within and across economies. It could also have substantial positive effects on macroeconomic performance as well as enhance regional and global economic integration and help economies achieve the Sustainable Development Goals. At the same time, policy makers must consider digitalization’s impacts on international capital flows, trade, and labor markets.

This ADBI-SKBI virtual conference will feature new research on the role of digitalization in enhancing sustainable, inclusive, and balanced growth in Asia. Areas of exploration will include its potential to reduce market entry barriers, lower inequality, and foster social and economic inclusion. Identifying policies that can leverage digitalization to promote sustainable development will be an additional focus.

10th Annual SKBI Conference on COVID-19, Financial Fragility and Resilience

Webinar, 2 December 2020

Even before COVID-19, many families were living without a savings buffer sufficient to cover significant and unexpected expenses. The sizable economic shock created by this year's pandemic exposed the high financial fragility of many households. This year’s SKBI Annual Conference will feature a keynote by the economist behind the concept of household financial fragility, Prof. Annamaria Lusardi, who will also highlight the positive role that financial education and literacy can play in building resilience against shocks such as COVID-19.

Prof. Anna will then discuss the situation in different parts of Asia Pacific with the former Indonesian Finance Minister, Muhamad Chatib Basri, the Deputy Governor of the Central Bank of the Philippines (BSP), Chuchi Fonacier, and Melbourne Institute Director, Abigail Payne. The welcome address will be made by SKBI Advisory Board Chair and Singapore Exchange CEO, Loh Boon Chye.

Workshop on Electricity and Environmental Markets

23 – 25 November 2020

SKBI hosted a workshop on Electricity and Environment facilitated by Professor Frank Wolak, Stanford University and Professor Alex Galetovic, Universidad Adolfo Ibáñez (Chile) & Hoover Institution (Stanford) over the 1.5 days. The participants spent majority of their time playing the roles of generating companies and load-serving entities in the game simulation. The objective of the workshop is to gain real-world experience with how environmental policies such as renewables portfolio standards, carbon taxes, and cap-and-trade markets for greenhouse gas (GHG) emissions interact with outcomes in a wholesale electricity market with conventional and intermittent renewable resources.

ADBI-JBF-SMU Joint Conference on Green and Ethical Finance

16 - 18 September 2020

The Sim Kee Boon Institute for Financial Economics co-hosted with the Asian Development Bank Institute and the Journal of Banking and Finance, the Conference on Green and Ethical Finance on 16-18 September 2020. The climate change challenge has raised important questions on the role of the financial sector in transforming the global economy towards a carbon-neutral equilibrium. Similarly, the experience of the Global Financial Crisis has raised important ethical and governance questions for financial sector actors, with the result that ESG (environmental, social and governance) dimensions are increasingly important for practitioners, regulators and academics. These topics, however, have only slowly started to attract the interest of researchers. With this conference, we hope to deepen and broaden this new strand of the literature further and support the development of policy recommendations in this area for Asia-Pacific economies.

Is This Time Different? Navigating the Transition to a Post-Covid World

9 July 2020

Prof Carmen Reinhart - Vice President and Chief Economist, World Bank Group

Co-hosts:

- Prof Maria Socorro Gochoco-Bautista, University of the Philippines

- Prof Dave Fernandez, Sim Kee Boon Institute for Financial Economics, Singapore Management University

Guest questioners:

- Carlos "Sonny" García Domínguez III, Secretary of Finance, Republic of the Philippines

- Karl Chua, Acting Secretary of Socioeconomic Planning, Republic of the Philippines

- Prof Benjamin Diokno, Governor, Bangko Sentral ng Pilipinas

The Importance of Data Connectivity in Financial Services

6 February 2020

Speaker, U.S. Treasury Under Secretary for International Affairs, Brent McIntosh discussed the impact of data connectivity and cross-border data flows in financial services on economic growth and financial stability. The ability to hold and transfer financial information securely has always been essential to the safe and efficient provision of financial services – and thus to economic growth. Data connectivity is critical to driving the productivity growth that is a key source of higher living standards in the future. Cross-border data flows are also essential to supporting financial stability, to ensure financial regulators have access to the information required to fulfill their mandates and promote the safety and soundness of the financial system. When data connectivity is imperiled, firms, consumers, and regulators are all worse off, and we risk losing out on the benefits of today’s digital economy. Under Secretary McIntosh discussed how policymakers can address these new and complex issues and why greater cooperation among financial authorities is key to ensure we all achieve the benefits of enhanced data connectivity in financial services.

9th Annual SKBI Conference 2019 on “Sustainable Finance"

7 – 8 November 2019

“Sustainable Finance” is one of the emerging research areas that we now focus on at the Sim Kee Boon Institute for Financial Economics (SKBI) and is also the title of our 9th Annual SKBI Conference. This two-day event, hosted in partnership with the TBLI Group of the Netherlands, will occur on 7-8 November 2019. The conference is intended for practitioners, policymakers, and academics. Along with plenary session keynote speeches and panels, there will be four separate sessions of parallel workshops to allow for smaller-group interactions.

Macroeconomic Stabilization in the Digital Age

16 – 17 October 2019

Over the past decade, the global financial crisis and the rise of the digital economy have created new challenges for the management of the economy. During this period, emerging economies have had to deal with large and volatile capital flows. While such capital flows can have substantial benefits for economies in terms of growth and development, they can also pose substantial risks if not properly managed. Achieving macroeconomic stability can be fraught with difficulty when capital inflows lead to greater volatility of domestic consumption, currency and maturity mismatches, as well as boom/bust cycles in asset prices. New approaches to capital flow management and improving resilience to capital flow shocks are thus more important than ever.

In conjunction with these developments, the onset and growth of fintech has implications for cross-border capital flows. Innovations related to payments systems, maturity transformation, and the allocation of capital can create challenges for macroeconomic stabilization to the extent that they disrupt the efficacy of policy tools used to manage the economy.

Selected papers were featured at the conference hosted at the Sim Kee Boon Institute at the Singapore Management University in Singapore on 16-17 October 2019.

Asia Pacific Financial Education Institute

16 - 17 September 2019

The Asia Pacific Financial Education Institute (APFEI) is a forum for presentation and discussion of financial education research. For this event, SKBI has partnered with the world's leading center for financial literacy research and policy, the Global Financial Literacy Excellence Center (GFLEC). Modelled after the “Cherry Blossom Financial Education Institute” held annually in Washington, DC, the APFEI’s goal is to promote excellent work in this field, foster research that can inform policy, and identify effective financial education programs, with a particular emphasis on Asia.

- View Day One (16 Sept) Photos

- View Day Two (17 Sept) Photos

- View the Papers and Presentation Slides

- Related Article: Fostering Research in Financial Literacy and Inclusion

Dialogue with Dr Mary Daly

7 June 2019

SMU Sim Kee Boon Institute for Financial Economics (SKBI) is honoured to host Dr Mary Daly, President & CEO, Federal Reserve Bank of San Francisco for a "Dialogue with Students" on 7 June 2019 at SMU.

Textual Sentiment and Sector specific reaction, by Professor Wolfgang Hardle

12 March 2019

ESG & Impact Investing: Current Status & Lessons Learned, by Robert Rubinstein

22 January 2019

High-mixed Frequency Forecasting Methods with Applications to Philippine GDP and Inflation

23 November 2018

- View the Presentation Slides.

- View the paper "High-mixed Frequency Forecasting Methods with Applications to Philippine GDP and Inflation".

8th Annual SKBI Conference 2018 on "Charting a Roadmap toward a New Data Regime for the Digital Economy"

20 - 21 June 2018

- Related Article: 8th SKBI Annual Conference discusses charting a roadmap toward a new data regime for the digital economy

- View Photos from Day One Conference (20 June 2018).

- View Photos from One Dinner (20 June 2018).

- View Photos from Day Two Conference (21 June 2018).

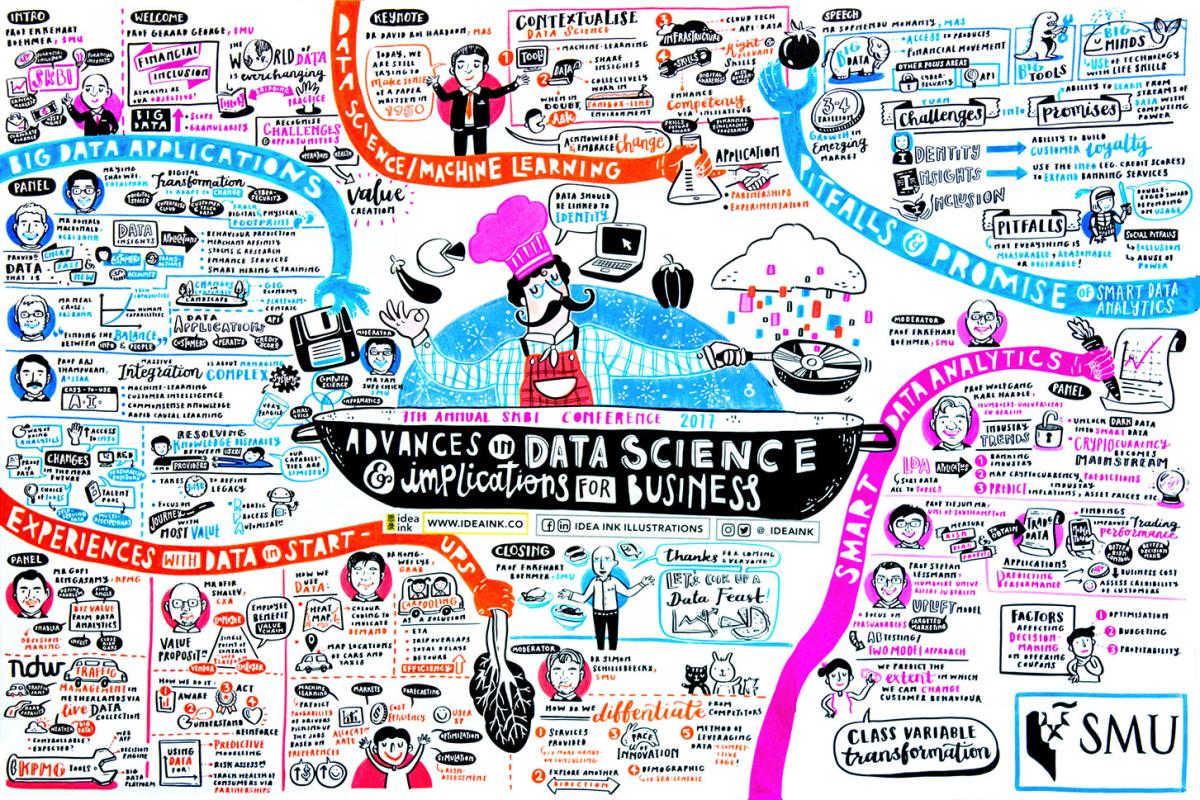

7th Annual SKBI Conference 2017 on "Advances in Data Science and Implications for Business"

26 May 2017

6th Annual SKBI Conference 2016 on FinTech and Financial Inclusion

"Nascent financial technologies for enhancing access to finance"

18 - 19 August 2016

The global financial landscape is changing with the advent of technologies such as blockchain, big data analytics, social networks and mobile payments. With the innovative use of technology (especially through cost reduction), the previously unbanked are now gaining access to financial services. lnclusivity is the next growth frontier in banking and finance. In this area, financial institutions face increasing competition from non-banks such as internet companies, telcos and start-ups that have moved into financial services through payment platforms; reaching the masses. Notable companies include Alipay (Ant Financial}, M-Pesa, Tencent, Google and Apple,

The conference aims to explore the growing use of financial technologies and how they can contribute to financial inclusion. Expert speakers (from various regions such as Subsaharan Africa, China, Japan and Asia), working in the area of technology and inclusion, will deliver their insights through keynote speeches and in-depth panel discussions.

Related Article: 6th SKBI Annual Conference discusses Fintech and Financial Inclusion

Seminar: Smart Contracts and Blockchains - Trends and Developments in China

1 June 2016

- Watch the video recording: Talks by Xiao Feng & Vitalik Buterin.

- Watch the video recording: Panel Discussion.

- View the speaker slides: Mr Xiao Feng, Vice Chairman, Wanxiang Holdings Limited (China).

- View the speaker slides: Mr Vitalik Buterin, Co-Founder, Ethereum.

SKBI-BFI Conference on "Smart Nation, Silicon Valley Technology and Connectivity Inclusion"

17 November 2015

In November 2014, Singapore's Prime Minister announced a wide range of initiatives (including aging, mobility and data sharing) to transform Singapore into a Smart Nation. The aim is to harness technology to make lives more convenient; improving connectedness within the country. Smart technology can also expand Singapore business into the region especially the ASEAN countries.

Our conference aims to create a forum for Singapore institutions to explore Silicon Valley technologies and their potential and will offer insights into the latest technologies which could be relevant and beneficial to the Smart Nation program. It will also serve as a platform for Silicon Valley to learn about this initiative in Singapore. Participants include a mix of major players from Singapore, Silicon Valley and global investors.

Startups, accelerators, incubators and VCs from Silicon Valley will be invited to speak at the conference. This includes presentations from tech companies and startups with products or services which could be interesting for the Smart Nation initiative.

- View photos of the Pre-Conference Dinner on 16 November 2015

- View photos of the Conference on 17 November 2015.

5th Annual SKBI Conference 2015 on "Digital Banking, Financial Inclusion and Impact Investing"

6 - 7 May 2015

Traditionally, Financial Inclusion, such as P2P lending, Crowdfunding and microinsurance, and Impact Investing are seen as the investment universe for those engaging in corporate social responsibility and not a mainstream activity. However, recent exodus of high-level bankers and "strats" to Fin Tech companies have increased the awareness of the disruption and opportunities in Digital Banking, Internet Finance, Blockchain and Consensus Ledgers. The listing of Lending Club that raised USS870 million last year has heightened concerns that the use of smart data from Internet and mobile wallet will begin to further threaten the profit margins of traditional banks, which already have been disrupted by Alibaba's Ants Financial (Alipay) and Safaricom's M-PESA. As a consequence of QE and after the steep run up of real estate and commodity prices, investors have also been searching for asset classes that exhibit negative correlation with the market. We are predicting for the next five years, alternative finance will be an area worthy of attention. Investors and financial institutions seeking for profit opportunities and higher return on equity in a low-growth environment flushed with liquidity will do well to take advantage of the digital revolution.

- View photos of Day One conference (6 May 2015).

- View photos of Day Two conference (7 May 2015).

- View photos of the Dinner (6 May 2015).

Inaugural CAIA-SKBI Cryptocurrency Conference 2014

4 November 2014

Sim Kee Boon Institute for Financial Economics (SKBI) in conjunction with Chartered Alternative Investment Analyst Association (CAIA) is honoured to host the'lnaugural CAIA-SKBI Cryptocurrency Conference 2014' on the 4th of November 2014. Cryptocurrencies have been gaining much attention recently as we observe industry leaders and institutions taking part in discussions on Bitcoin or buying stakes in the cryptocurrency industry. It can potentially change the way businesses are conducted, and challenge established institutions such as central banks, exchanges, and even governments. This conference will be an opportunity for industry professionals and regulators to improve their understanding of the area and explore how their institutions can address or engage in this technology. We aim to explore implications of crypto-currencies and the underlying technologies via in-depth panel discussions with industry stake holders; this will include financial institutions, venture capitalists, cryptocurrency entrepreneurs, lawyers and accountants.