Green Spark in Private Equity: The Role of Investors

Read the full insights from the SKBI Newsletter (Mar 2026 Edition).

Rethinking Financial Advice: Human vs Robo Interface

Read the full insights from the SKBI Newsletter (Feb 2026 Edition).

Case Insights: Impacts of U.S. Environmental Regulations on Industry.png)

Read the full insights from the SKBI Newsletter (Dec 2025 Edition).

Behavioural Policy Uncertainty & Green Investment

Read the full insights from the SKBI Newsletter (Nov 2025 Edition).

Does Experience Teach Us Wisdom or Lead Us Astray?

Read the full insights from the SKBI Newsletter (Oct 2025 Edition).

Do Bank CEOs learn from Crises?

Read the full insights from the SKBI Newsletter (May 2025 Edition).

A look at Carbon Markets and Policies

Read the full insights from the SKBI Newsletter (Apr 2025 Edition).

Digital disruption – A make-or-break in banking

Read the full insights from the SKBI Newsletter (Mar2025 Edition).

Can Humans Understand Machines in Finance?

Read the full insights from the SKBI Newsletter (Feb 2025 Edition).

ESG Information: Impacts and Incentives

Read the full insights from the SKBI Newsletter (Dec 2024 Edition).

Wading Into Challenges in Household Finance & Investments

Read the full insights from the SKBI Newsletter (Nov 2024 Edition).

Challenges & Benefits of Diversity in Hedge Funds

Read the full insights from the SKBI Newsletter (Oct 2024 Edition).

Summary from the SKBI Industry Workshop: AI Meets Finance - A computer science & industry perspective

3 key takeaways from "Interim Report: Green FinTech and Data Centres in Singapore"

3 key takeaways from "E-DSGE model with endogenous"

3 key takeaways from "ASEAN Renewables: Opportunities and Challenges"

3 key takeaways from "Are Markets Interested in Adapting to Climate? Insights from Singapore"

The hedge fund industry is an important laboratory for studying responsible investment for three reasons.

Linkages Between GHG Emissions Scenarios, Temperature Rises & Physical Climate Risk Events in South East Asia

3 key takeaways from "Downscaling of Physical Risks for Climate Scenario Design"

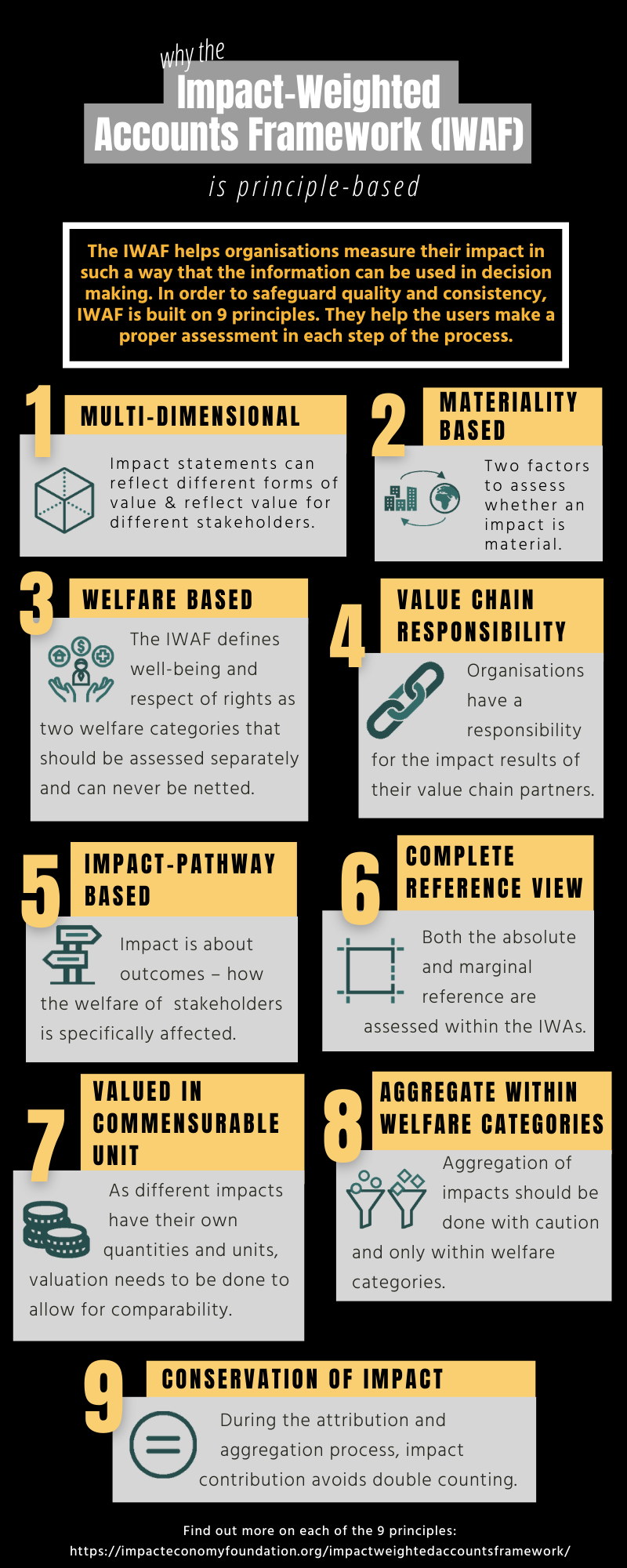

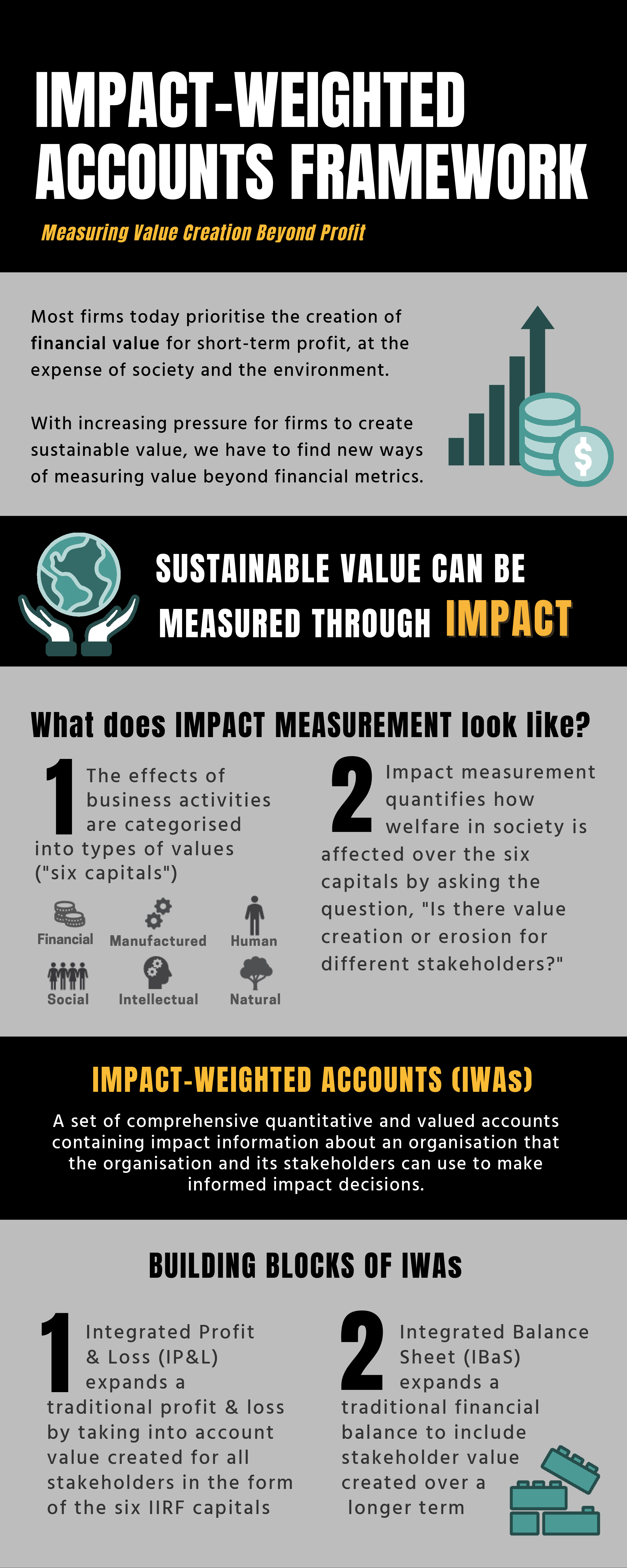

Why the IWAF is principle-based?

To discover each individual principle, download the full version.

*Participate in the IWAF public consultation here.

Why the IWAF is relevant for investors?

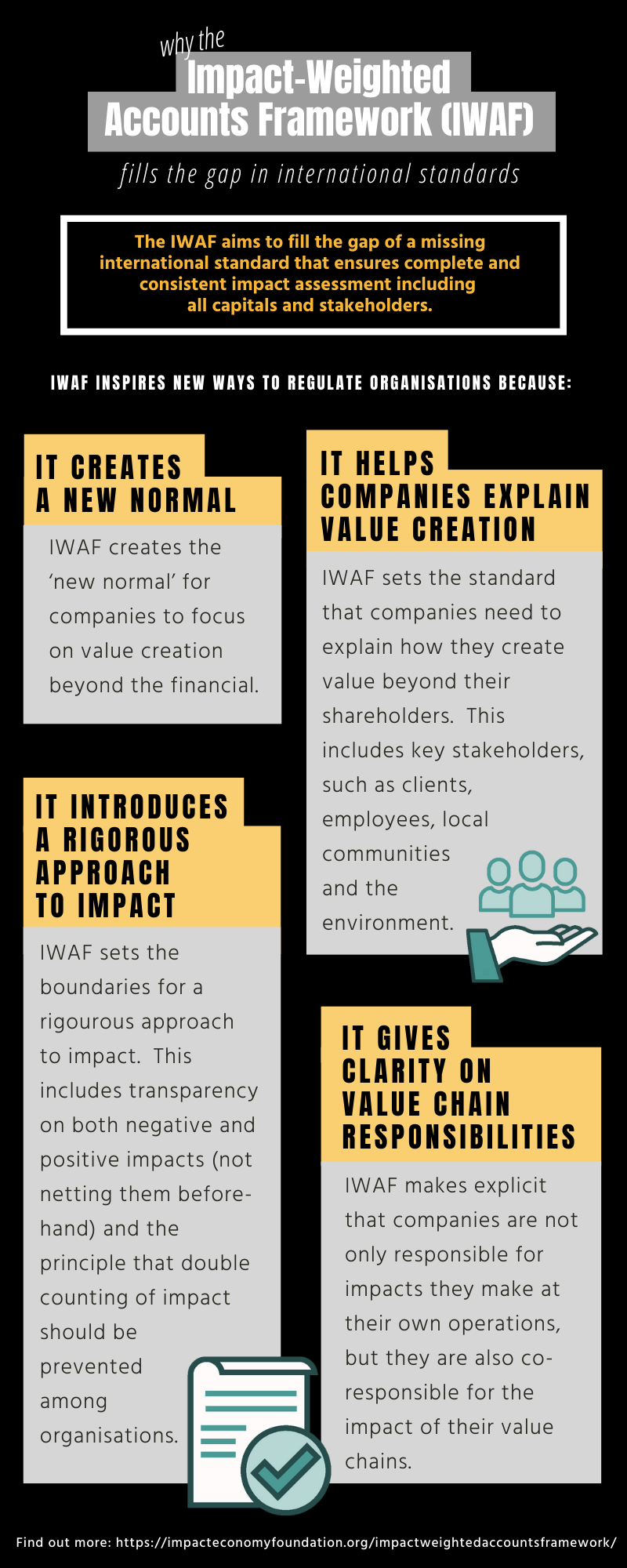

Why the IWAF fills gaps in international standards?

Why is the IWAF Important for Governments and Regulators?

%20is%20relevant%20for%20governments%20and%20regulators.png)

Why is the IWAF Important for Organisations & Financial Institutions?

%20Aids%20Organisations%20%26%20Financial%20Institutions.jpg)

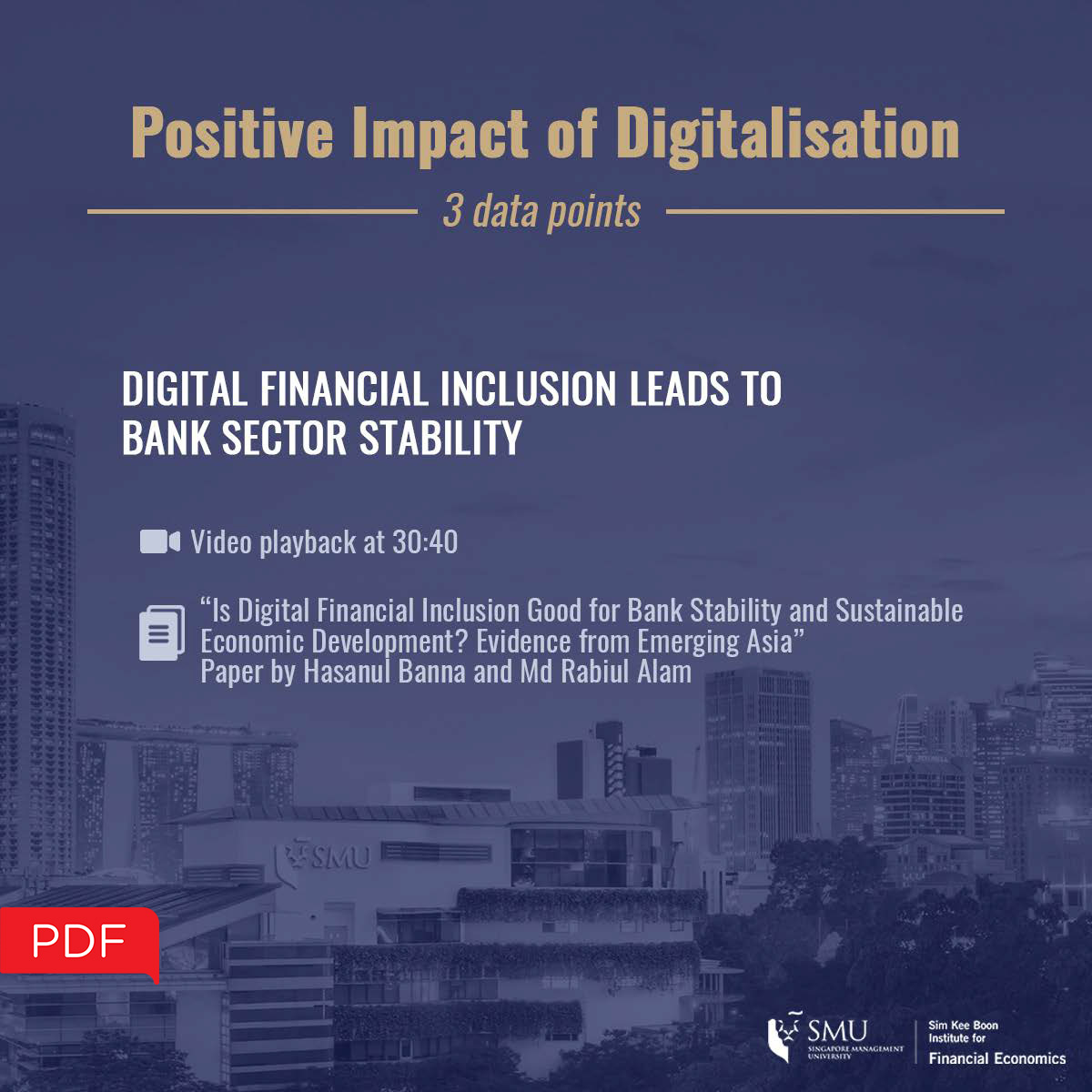

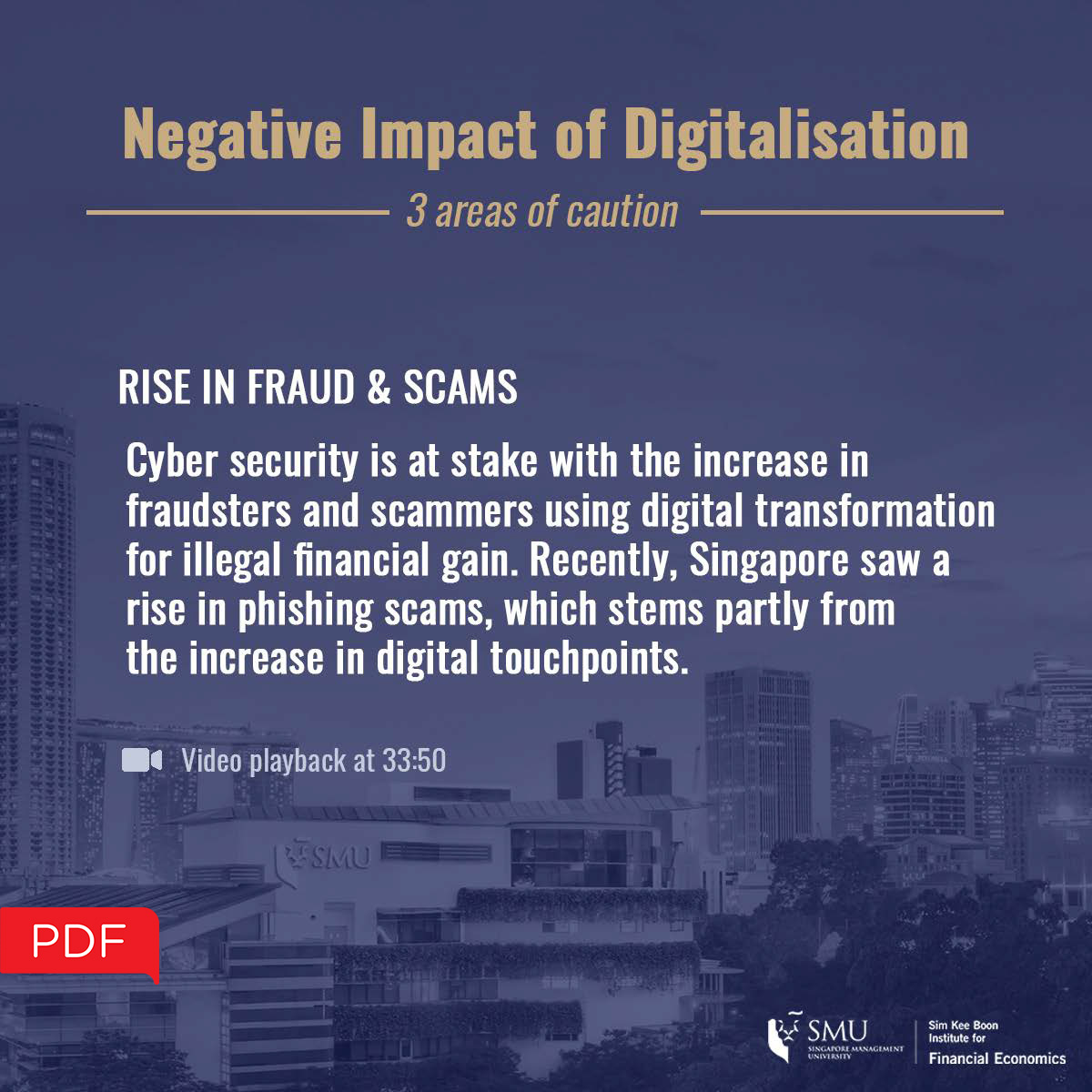

ABFER-ABS Industry Outreach Panel: The Impact of Fin-tech Revolution, Digitalisation and Digital Currencies on the Financial System

|  |

3 Key Takeaways: Impact Measurement and Standards (White Paper)

4 Common ESG Reporting Problems & SGFC’s Solution to Curb Greenwashing

.png)