The sharp rise in inflation affects every household and highlights the importance of personal financial literacy and education. SMU will host the Asia Pacific Financial Education Institute (APFEI) on 17-18 November which will feature new academic research in this emerging field. The papers will cover topics like Financial Education and Spillover Effects, Retirement Planning Tools, Financial Literacy in Housing Markets, Fintech Nudges including Overspending Messages, Retirement Savings Behaviour in Thailand, and Sustainable Finance Literacy.

This is also the first APFEI conference under the “G53 Financial Literacy and Personal Finance Research Network” – a network which connects top scholars around the world to facilitate the exchange of ideas, promote evidence-based research, and meet the growing urgency for data-driven solutions. The G53 Network is powered by the Global Financial Literacy Excellence Center at the George Washington University School of Business, the Sim Kee Boon Institute for Financial Economics at the SMU, and Next Gen Personal Finance. There will also be panels with personal finance practitioners, including one organised by the Money Awareness and Inclusion Awards (MAIA), which celebrates the work being done to help people understand money better, and benefit from the financial system.

Catch up on last year's Asia Pacific Financial Education Institute here.

Date & Time:

November 17-18, 2022

Format:

Hybrid

Programme, Video Recording & Resources:

Click on the corresponding sections below to watch the video recording and download the slides/papers.

THURSDAY, NOVEMBER 17

|

|

|

8:30 am –9:00 am |

Registration and Breakfast |

|

9:00 am –9:15 am |

Welcome & Introductory Remarks [Video Recording]

|

|

9:15 am –10:30 am |

Session 1 [Video Recording] Retirement Savings Adequacy in U.S. Defined Contribution Plans [Slides|Paper] Are Retirement Planning Tools Substitutes or Complements to Financial Capability? [Slides] |

|

10:30 am – 11:15 am |

Keynote 1: New Frontiers of Robo-Advising: Consumption, Saving, Debt Management, and Taxes [Video Recording|Slides] |

|

11:15 am – 11:30 am |

Break |

|

11:30 am – 12:45 pm |

Session 2 [Video Recording] Missing the Target? Retirement Expectations and Target Date Funds [Slides] Good Intentions, Financial Literacy, and Retirement Savings Behaviours in the Time of COVID-19: Evidence from Thailand |

|

12:45 pm – 2:00 pm |

Lunch |

|

2:00 pm – 3:15 pm |

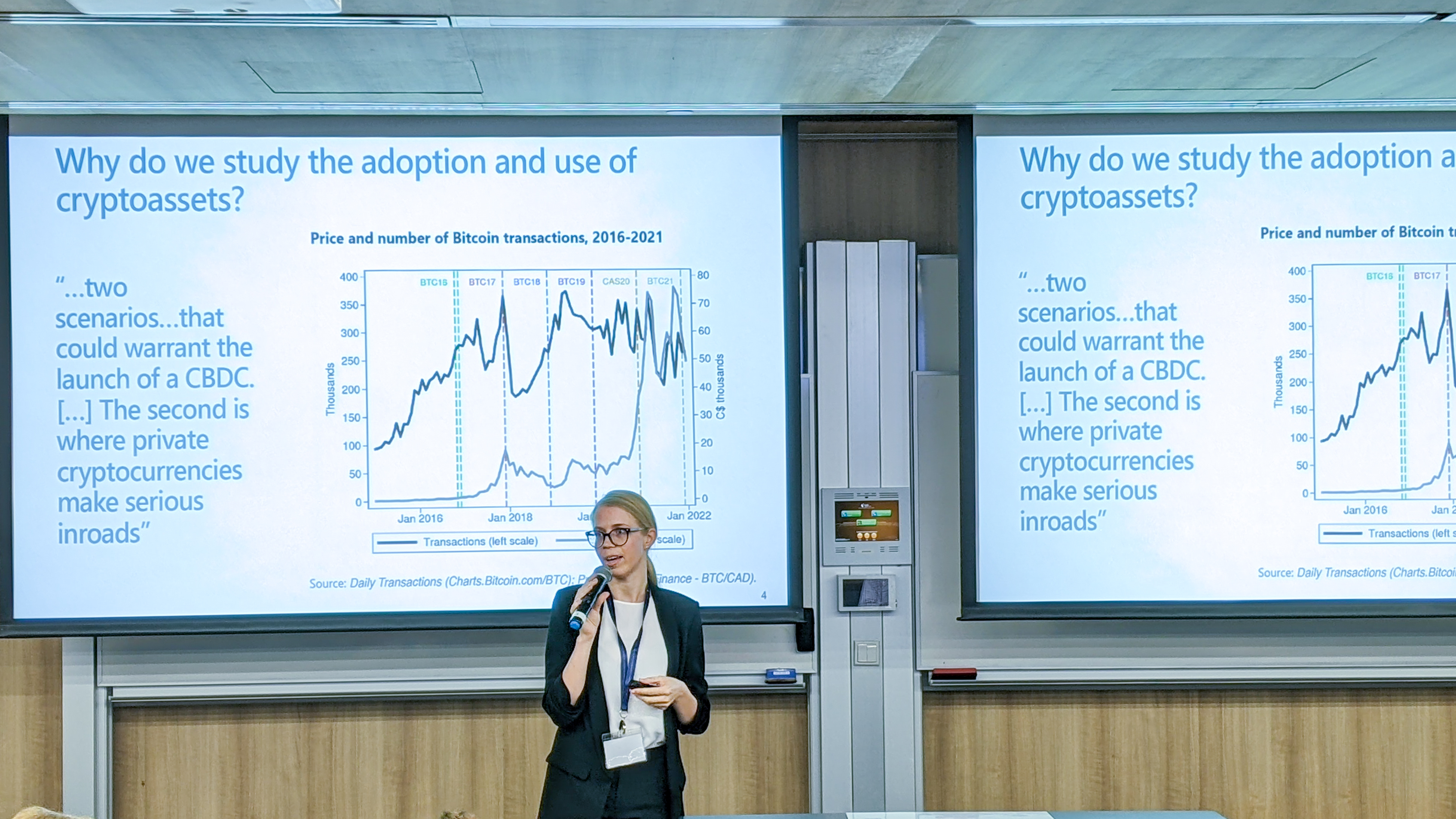

Session 3 [Video Recording] Private Digital Cryptoassets as Investment? Bitcoin Ownership and Usage in Canada, 2016-2021 [Paper] Fintech Nudges: Overspending Messages and Personal Finance Management [Paper] |

|

3:15 pm – 4:30 pm |

Session 4 [Video Recording] Financial Education and Spillover Effects [Slides|Paper] Sustainable Finance Literacy and the Determinants of Sustainable Investing [Slides|Paper] |

|

4:30 pm –4:40 pm |

Closing Remarks [Video Recording] |

FRIDAY, NOVEMBER 18

|

|

|

8:30 am – 9:00 am |

Registration and Breakfast |

|

9:00 am – 9:05 am |

Welcome Remarks [Video Recording] |

|

9:05 am – 10:15 am |

Panel 1: Financial Education Practitioners [Video Recording]

|

|

10:15 am – 10:30 am |

Break |

|

10:30 am – 11:30 am |

Panel 2: Financial Education Policymakers [Video Recording]

|

|

11:30 pm – 12:30 pm |

Panel 3: Financial Education Academics [Video Recording]

|

|

12:30 pm – 12:35 pm |

Closing Remarks [Video Recording] |

|

12:35 pm – 1:30 pm |

Lunch |

Dave Fernandez (Sim Kee Boon Institute)

Dave Fernandez (Sim Kee Boon Institute) Annamaria Lusardi (Global Financial Literacy Excellence Center)

Annamaria Lusardi (Global Financial Literacy Excellence Center) Session Chair: Charles Horioka (Kobe University)

Session Chair: Charles Horioka (Kobe University) Enrichetta Ravina (Federal Reserve Bank of Chicago)

Enrichetta Ravina (Federal Reserve Bank of Chicago) Jiusi Xiao (Claremont Graduate University)

Jiusi Xiao (Claremont Graduate University) Alberto Rossi (Georgetown University)

Alberto Rossi (Georgetown University) Byeong-Je An (Nanyang Technological University)

Byeong-Je An (Nanyang Technological University) Paul Gerrans (The University of Western Australia)

Paul Gerrans (The University of Western Australia) Daniela Balutel (York University)

Daniela Balutel (York University) Sung Kwan Lee (Chinese University of Hong Kong, Shenzhen)

Sung Kwan Lee (Chinese University of Hong Kong, Shenzhen) Session Chair: Shizuka Sekita (Kyoto Sangyo University)

Session Chair: Shizuka Sekita (Kyoto Sangyo University) Andreas Milidonis (University of Cyprus)

Andreas Milidonis (University of Cyprus) Tobias Wekhof (ETH Zurich)

Tobias Wekhof (ETH Zurich) Moderator: Michael Gilmore (Founder, MAIAs)

Moderator: Michael Gilmore (Founder, MAIAs) Rosalia Gitau (CEO, Bixie)

Rosalia Gitau (CEO, Bixie) Maria Hoyos (Co-Founder, GoNsave)

Maria Hoyos (Co-Founder, GoNsave) Tiffany Liu (Co-Founder, Gen Z Group)

Tiffany Liu (Co-Founder, Gen Z Group) Moderator: Dame Diana Crossan (Chair, GFLEC Advisory Council)

Moderator: Dame Diana Crossan (Chair, GFLEC Advisory Council)  Don Nakornthab (Senior Director, Bank of Thailand)

Don Nakornthab (Senior Director, Bank of Thailand)  Joanne Yoong (Visiting Scholar, Singapore Management University)

Joanne Yoong (Visiting Scholar, Singapore Management University)