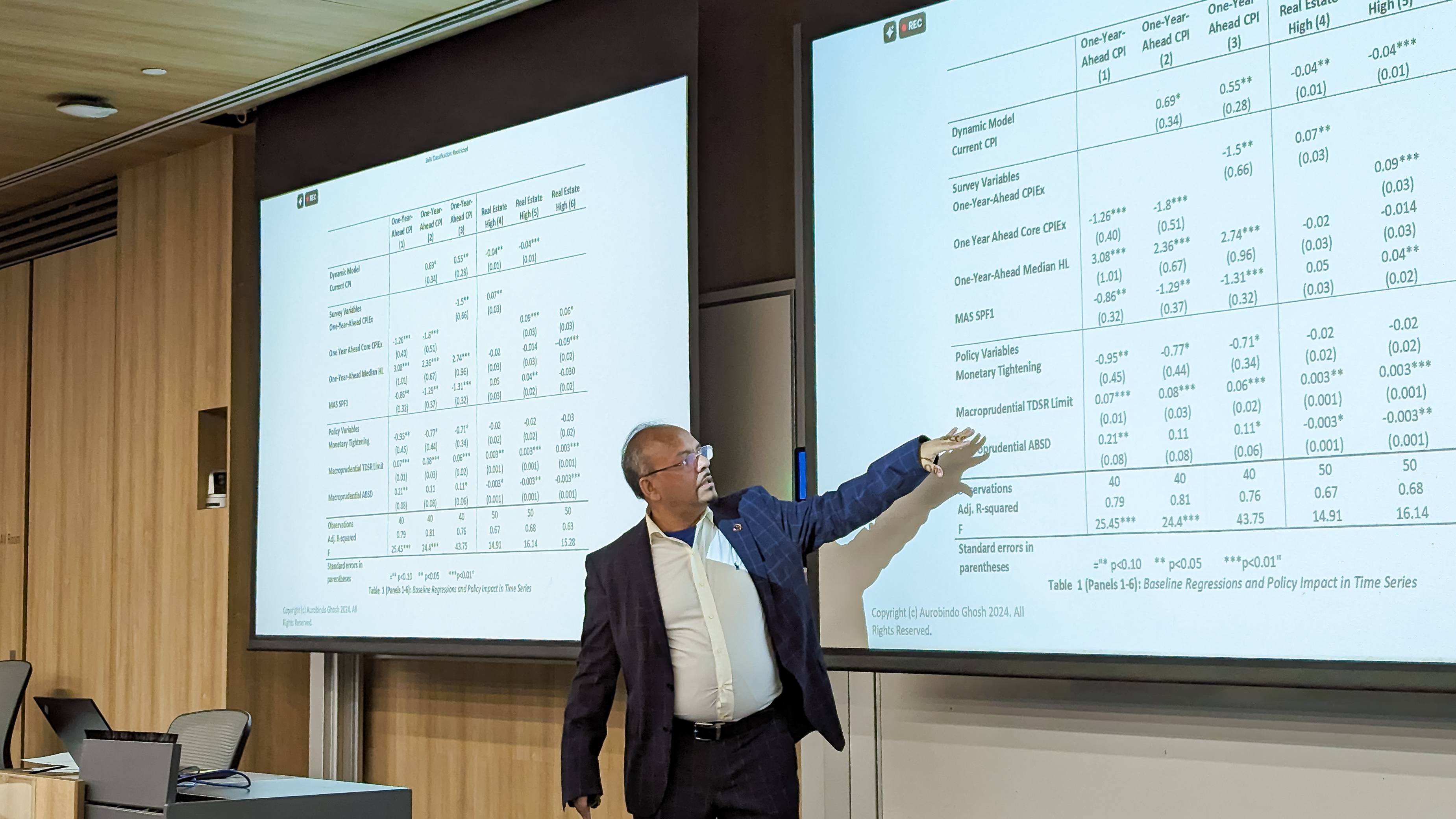

Despite an extended period of heightened interest rate, and prospects of a global slowdown, inflation doesn’t seem to go away. Stronger than expected jobs report and higher than expected March 2024 inflation in the US reduced the possibility of June 2024 rate cuts, thus dragging the market down. However, such expectations are not inconsequential to global growth or personal wealth. “Higher for longer” US interest rate in conjunction with resurgent commodity prices might be detrimental to financial sustainability of lower income economies. Individual consumers and investors are also facing the brunt of the inflation and cost of living pressure with strategic pricing decisions made by corporate actions. In this session, we will explore some findings from the latest round of SInDEx Inflation Expectations Survey (51st edition), some insights from analytics and a panel sharing on possible challenges and ways of dealing with cost of living increases and personal financial decisions.

In the presentations and panel discussion, using data and analysis, our panellists will shed some light on the instruments of price increases and how we can potentially address these questions as academics, practitioners, policymakers, businesses, and consumers.