These are the research findings of the 50th round of the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey at the Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University (SMU).

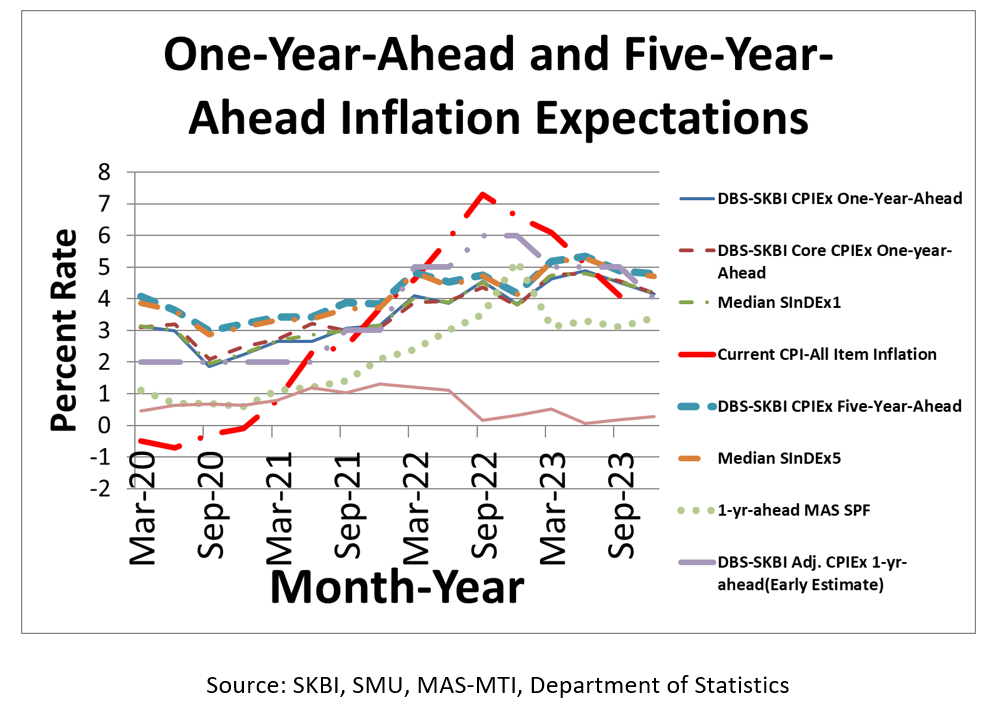

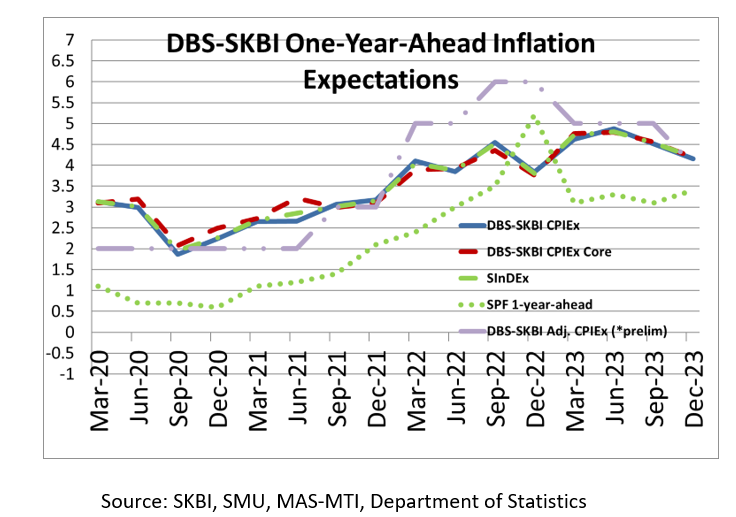

- One-year-Ahead headline inflation expectations dipped to 4.2% in December 2023, from 4.5% in September 2023. Consumers’ inflation expectations continued their downward trend which started in March 2023, following global cues of dampening global growth and a moderating inflationary environment. Nonetheless, the fourth quarter One-year-Ahead inflation expectations continue to be higher than the average One-year-Ahead headline inflation expectations of 3.3% since the inception of this index in the third quarter of 2011.

- As a comparison benchmark, data from the Monetary Authority of Singapore Survey of Professional Forecasters (MAS SPF) released in December 2023 showed that the median forecast of the Consumer Price Index (CPI)-All Items inflation for 2023 was 4.8% (for 2024, 3.4%) while MAS Core Inflation median forecast was 4.1% (for 2024, 3.0%). The latest CPI data release from the Department of Statistics showed that CPI-All Items rose by 4.9% between January and November 2023, compared to the same period in 2022, with the latest November 2023 monthly inflation print coming in at 3.6% year-on-year. On 13 October 2023, MAS maintained the rate of appreciation of the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy band, following five consecutive tightening moves between October 2021 and October 2022. The current appreciating path of the S$NEER policy band will continue to reduce imported inflation and help curb domestic cost pressures, thereby ensuring medium-term price stability. The next monetary policy statement will be announced in January 2024.

- The overall Consumer Price Index (CPI) Inflation Expectations (CPIEx), after adjusting for potential component-wise behavioural biases and re-combining across components, declined to 4.76% in December 2023 from 5.0% in September 2023. One-year-Ahead inflation expectations of major components of CPI like Food (at 5%), Transportation (at 5%), Housing & Utilities (at 5%), Healthcare (at 5%) and Miscellaneous Goods and Services including personal care (at 5%) stayed unchanged while all other components declined between the September 2023 and December 2023 surveys – Education (from 5% to 4%), Recreation & Culture (from 5% to 4.2%), Clothing & Footwear (from 5% to 4%), Household Durables & Services (from 5% to 4%) and Communications (from 5% to 4%). Higher demand related to Travel, Food & Beverage and Accommodation might have been met with commensurate increase in supply, which led to flattening or lowering of inflation expectations across the board.

- The survey team also polled free-response overall inflation expectations after accommodating potential behavioural biases. We found that the One-year-Ahead headline inflation expectations dipped from 5% to 4% while the inflation expectations, after stripping out accommodation and private transportation, remained unchanged at 5% between the surveys in September 2023 and December 2023. These free-response polls help us to gauge perceptions of anchoring of inflation expectations and consumer sentiments in an aggregated sense.

- In the December 2023 survey, continuing from the June 2022 survey, we took a more forward-looking approach to analyse the impact of global economic developments on Singapore’s economic growth and inflation.

- Overall, given the uncertainties stemming from geo-political conflicts and strategic tensions, global growth prospects and consequently continuation of policy tightening – albeit at a measured pace – of monetary policies by major economies, a tight domestic job market and general cost-of-living pressures, Singaporean consumers expect a slight negative impact on Singapore’s economic growth over the next 12 months.

- Singaporean consumers also opined that over the next 12 months, their overall expenses are expected to increase slightly.

- In the December 2023 survey, Singaporean consumers polled had divergent views on how they felt the overall inflation scenario would unfold in the next 12 months. Around 48.6% (compared to 49.5% in September 2023) of those surveyed expect inflation to decline while 42.2% (compared to 44% in September 2023) felt that it will increase.

- The main reason cited by those expecting inflation to decline is the slowdown of global growth (42%). The increase in interest rates by major central banks was cited by 33% and this is the second most common reason given. A distant third, at 17.6%, felt the resolution of supply chain disruptions is also expected to relieve price pressures. Among respondents expecting inflation to increase over the next 12 months, the most common reasons cited were geopolitical uncertainties due to the conflicts between Ukraine and Russia and elsewhere (28%), closely followed by central banks in major economies raising interest rates (37%), high demand due to easing of COVID-19 restrictions (20%) while supply chain disruptions only account for 15% of those who thought price levels will increase.

- In the December 2023 survey, respondents opined that current economic conditions have a limited negative impact on One-year-Ahead and Five-year-Ahead overall inflation expectations, although there is significant variation or “cognitive dissonance” among the respondents. Component-wise, respondents expect a slight negative impact on inflation of Food, Transportation, Housing & Utilities, Healthcare, Household Durables & Services, while there was no such discernible negative impact on Education, Recreation & Culture, Communications, Clothing & Footwear and Miscellaneous Goods & Services.

- Alberto Cavallo of Harvard Business School (Cavallo, 2020) and a report by the European Central Bank (Kouvavas et al., 2020) highlighted potential biases in CPI calculations with fixed baskets as respondents made substantive changes to their consumption baskets owing mainly to the Covid-19 pandemic. In the December 2023 survey, Singapore consumers polled that in the next 12 months they would expect no change in budget share of expenses for Food, Education Recreation & Culture, Communications, Clothing & Footwear, Household Durables & Services and Miscellaneous Goods & Services. However, the respondents expected a slight increase in the budget share of expenses in Transportation, Housing & Utilities and Healthcare. These results indicated that respondents expected their consumption baskets to change with higher budget share on certain components over the next 12 months rather than others, potentially because of more permanent consumption changes in post-pandemic relative consumption and price patterns across the board.

- Excluding inflation expectations in accommodation and private transportation, the One-year-Ahead CPIEx core inflation expectations for this SInDEx survey dropped to 4.2% in December 2023 from 4.6% in September 2023. This signalled the decline in overall inflation was broad-based and was not entirely driven just by the more volatile changes in COE premiums in recent months.

- For a subgroup of the population who owns their accommodation and uses public transport, the One-year-Ahead CPIEx core inflation expectations declined to 4.2% in December 2023 from 4.6% in September 2023, consistent with the overall decline in inflation expectations – verifying the robustness of the findings. This sub-sample measurement is potentially more representative than the full sample measurement, due to high home ownership and public transport ridership in Singapore.

- Unlike the fixed radio button response which might be susceptible to various behavioural biases, core CPIEx Inflation Expectations (excluding accommodation and private transportation expenses), after adjusting for potential component-wise behavioural biases and re-combining across components, declined to 4.6% in December 2023 from 5.0% in September 2023 survey. The free-response core CPIEx Inflation Expectations, however, stayed unchanged at 5% in December 2023 compared to the September 2023 survey, possibly signalling consumers expect to adjust consumption baskets based on changes in relative component prices.

- The One-year-Ahead composite index SInDEx1 that puts less weight on more volatile components like Accommodation, Private Road Transport, Food and Energy-related expenses polled at 4.2% in December 2023, lower than 4.5% in September 2023. It continued to be higher than the second quarter average of 3.3% during the survey’s existence from 2011-2022.

-

In addition, in December 2023, only 7.8% of Singaporeans polled expect a more than 5.0% reduction in salary in the next 12 months, compared to 10.5% of respondents in September 2023, a significant improvement in the job outlook. The median salary increment expectation of a 1.0% to 5.0% increase remained unchanged compared to the September 2023 survey.

Figure 1: One-year-Ahead inflation expectations: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding accommodation and private road transportation components) One-year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDEx) Survey conducted on a representative sample of Singaporean residents between 21 December and 28 December 2023.

DBS Chief Economist and Managing Director of Group Research, Dr. Taimur Baig commented, “Singapore’s open economic structure leaves it quick to absorb both positive and negative shocks. A couple of years ago, global supply shocks transmitted a sharp rise in inflation; now inflation is receding, following global cues. Accordingly, near-term inflation expectations are adjusting downward, picked up aptly in the DBS-SKBI survey.”

Dr. Aurobindo Ghosh, Assistant Professor of Finance at Singapore Management University (SMU), the creator and the founding Principal Investigator of the Quarterly DBS-SKBI SInDEx Project, observed, “Following the dovish statement by Chairman Jerome Powell of the US Federal Reserve Board after the December 2023 Federal Open Market Committee (FOMC) meetings, signalling a potential pause in the monetary policy tightening cycle.” He also hinted at multiple rate cuts in 2024, potentially in the second half of the year. He said, “As expected, the financial market and borrowers heaved a collective sigh of relief. Although not completely out of the woods with the risk of unhinged inflation and reaching the target 2% inflation, the most recent release of the Survey of Consumer Expectations in December 2023 (an online survey of representative sample in the US conducted by the New York Fed) showed that inflation expectations have moderated across all horizons (1 Year, 3 years and 5 years, Survey of Consumer Expenditure 2023) for US consumers with the one year ahead inflation expectations dropping to 3.0% from 3.4%. A potential weakening of the US dollar, a reduction in the cost of US dollar-denominated debt and a potential denouement in sight of the escalating cost of living, might be the ideal trifecta consumers and oil-importing countries were looking for.”

“In Singapore domestically, the moderation in expectations might have been slightly dampened by the 1% increase in Goods and Services Tax (GST) in 2024, although Singaporeans opined that a slowdown in global growth might also limit any significant increase in overall price levels. The overall and component-wise inflation expectations of Singaporean consumers have largely declined, even after accommodating for behavioural biases, indicating some levels of anchoring of medium-and long-term inflation expectations.”

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations declined slightly to 4.8% in December 2023 from 4.9% in the September 2023 survey. The current polled number continues to be higher than the first quarter average of 4% polled since the survey’s inception in September 2011 up till 2022.

The Five-year-Ahead CPIEx core inflation expectations (excluding accommodation and private road transportation related costs) also dipped to 4.7% in December2023 from 4.8% in September 2023. Overall, the composite Five-year-Ahead SInDEx5 also reduced slightly to 4.7% in December 2023 from 4.9% in September 2023. In comparison, the fourth quarter average value of the composite Five-year-Ahead SInDEx5 is 3.9%, since the survey’s inception in September 2011 up till 2022.

After adjusting for potential behavioural biases, the free-response Five-year-Ahead Headline Inflation Expectations remained unchanged in December 2023 compared to 5% in September 2023, while the free-response Core Five-year-Ahead Inflation Expectations also remained unchanged in December 2023 at 5% in September 2023. This might reflect that slower global growth prospects are counteracting potential of higher inflation due to geopolitical conflicts and higher cost of living despite relatively high interest rates in major economies.

Assistant Professor Ghosh said, “Policymakers including the IMF have stressed the complementary role of monetary policy frameworks, including communication strategies, in helping achieve disinflation at a lower cost to output through managing agents’ inflation expectations. Our current data for both medium and long-term inflation expectations, seem to show signs of the effectiveness of the monetary policy leading to anchored inflation expectations.”

He added, “Despite the incidence of behavioural biases including those due to traditional gender-specific roles, survey-based measures of inflation expectations provide some critical information about how consumers process information, make consumption and investment decisions (Weber et al., 2022, Ang et al., 2007). DBS-SKBI SInDEx quarterly survey, completing its milestone 50th quarterly report, is one of the longest running surveys organised by researchers in a bank and an academic partner. It has addressed some of the behavioural biases through multiple methods of finding inflation expectations of respondents while providing them with relevant information to make a more informed judgement (Clark et al., 2018).”

References:

Ang, A., G. Bekaert, and M. Wei., 2007, “Do Macro Variables, Asset Markets, or Surveys Forecast Inflation Better?” Journal of Monetary Economics, 54:4, pp. 1163–212.

Cavallo, A., 2020, "Inflation with COVID Consumption Baskets." NBER Working Paper Series, No. 27352, June 2020 (Harvard Business School Working Paper, No. 20-124, May 2020). (https://www.hbs.edu/faculty/Pages/item.aspx?num=58253, accessed on July 14, 2020)

Clark, A., A. Ghosh and S. Hanes, 2018, “Inflation Expectations In Singapore: A Behavioural Approach,” Macroeconomic Review, Vol 17:1, pp. 89-98.

Kouvavas, O., R. Trezzi, M. Eiglsperger, B. Goldhammer and E. Goncalves, 2020, “Consumption patterns and inflation measurement issues during the COVID-19 pandemic,” ECB Economic Bulletin, Issue 7/2020. (https://www.ecb.europa.eu/pub/economic-bulletin/html/eb202007.en.html#toc6, accessed on July 14, 2020)

Survey of Consumer Expenditure (SCE), 2023, “Inflation Expectations Decline Across All Horizons,” (Press Release on Jan 8, 2024), https://www.newyorkfed.org/newsevents/news/research/2024/20240108 (Accessed on Jan 11, 2024).

Weber, M., F. D’Acunto, Y. Gorodnichenko and O. Coibion, 2022, “The Subjective Inflation Expectations of Households and Firms: Measurement, Determinants, and Implications,” Journal of Economic Perspectives, 36:3, pp. 157–184.

Methodology

DBS-SKBI SInDEx survey yields CPIEx Inflation Expectations (estimating headline inflation expectations) and related indices are products of the online quarterly survey of around 500 randomly selected individuals representing a cross section of Singaporean households. The survey is led by Principal Investigator Dr Aurobindo Ghosh, Assistant Professor of Finance (Education) at Lee Kong Chian School of Business of the Singapore management University. The online survey, powered by Agility Research and Strategy, helps researchers understand the behavior and sentiments of decision makers in Singaporean households. DBS Group Research is a co-sponsor and research partner with the Sim Kee Boon Institute for Financial Economics (SKBI) at SMU.

The quarterly DBS-SKBI SInDEx survey has also yielded two composite indices, SInDEx1 and SInDEx5. SInDEx1 and SInDEx5 measure the One-year inflation expectations and the Five-year inflation expectations, respectively. The sampling was done using a quota sample over gender, age and residency status to ensure representativeness of the sample. Employees in some sectors like journalism and marketing were excluded as that might have an effect on their responses to questions on consumption behavior and expectations.

The DBS-SKBI SInDEx survey was augmented in June 2018, based on a joint research study conducted by SMU researchers in collaboration with MAS and the Behavioural Insights Team, where respondents were polled on their perceptions of components of the Consumers Price Index (CPI) and adjusted for possible behavioural biases prevalent in online surveys.

Based on the recommendations of the joint study, since March 2019 the research team has polled the One-year-Ahead inflation expectations of all of the major components of CPI-All Items inflation. For December 2023 survey, DBS-SKBI CPIEx headline inflation expectations indices declined compared to September 2023. The core inflation expectations also declined similarly. Further, the behaviourally adjusted component-wise and recombined inflation expectations, and the overall behaviourally adjusted indices declined almost across the board except remaining unchanged for Food, Transport, Housing & Utilities, Healthcare and Miscellaneous Goods & Services. In free-response answers, compared to September 2023 survey, responses in the December 2023 survey polled for One-year-Ahead Headline declined and Core Inflation Expectations remained unchanged, signalling some levels of anchoring. Overall, the results indicate a slowdown and flattening of the trend of medium and long inflation expectations.

We introduced a new ratio in the June 2020 survey, on the life versus livelihood debate as an aftermath of the Covid-19 pandemic – the ratio of respondents who feels livelihood should be prioritised over life vis-à-vis those who feel the other way. This ratio declined slightly from 3.3 in September 2023 to 2.6 in December 2023. For every respondent who prioritised life over livelihood, there were about 3 who prioritised livelihood over life, signalling life returning to normal with an endemic Covid-19 in Singapore.