These are the research findings of the 43rd round of quarterly release for the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey at the Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University (SMU).

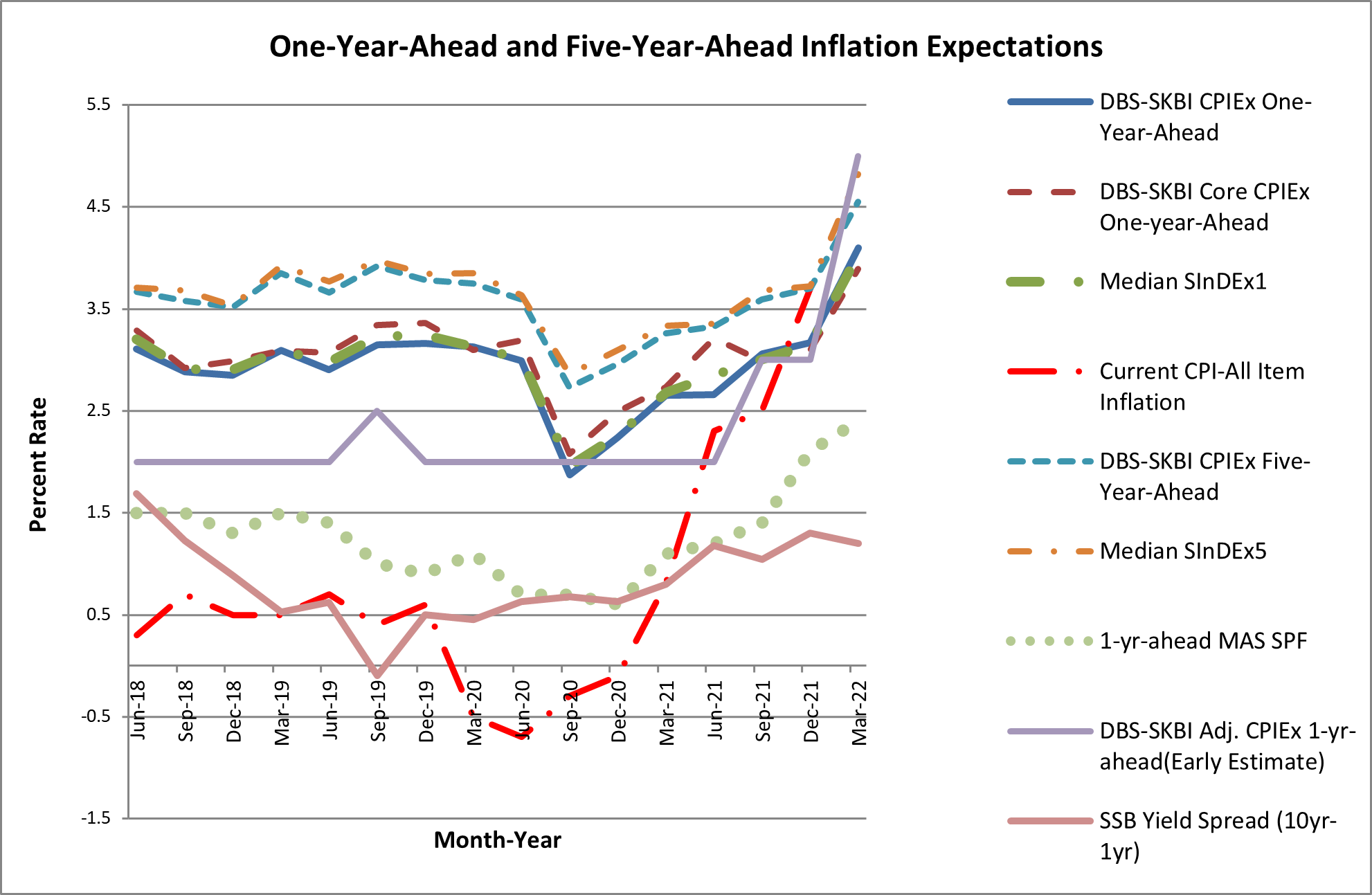

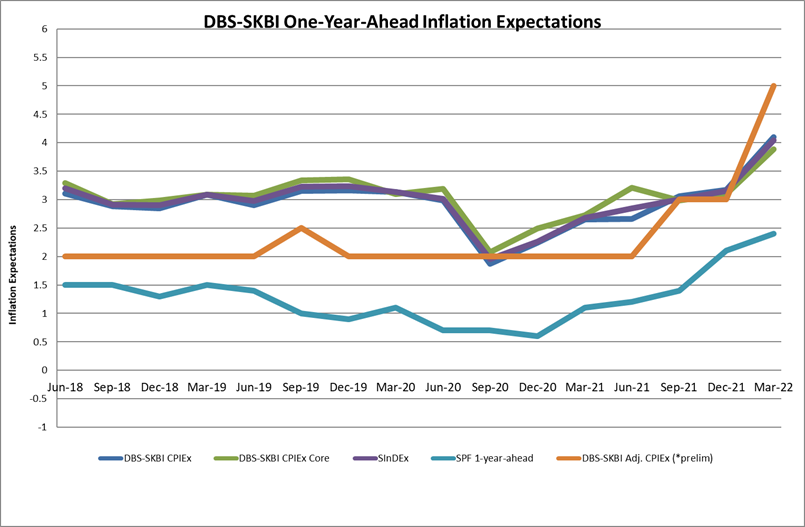

- One-year-Ahead CPIEx headline inflation expectations elevated to 4.1% in March 2022, compared to 3.2% in December 2021. Headline inflation expectation continued its upward trend since September 2020. The current polled CPIEx headline inflation expectations is significantly higher than the historical (2012-2021) first quarter average of 3.3%, and is the highest it has been since December 2012 when it last recorded above 4%.

- As a comparison benchmark, the MAS Survey of Professional Forecasters (MAS SPF) data released in March 2022 showed that the median forecasts of CPI All-Items inflation for 2023 was 2.4%. In the latest release from Department of Statistics, CPI-All Items inflation rose to 4.3% year on year in February, from 2.3% in 2021, following a mild deflation in 2020. In recognition of the fresh shocks to global commodity prices and supply chains which are adding to domestic cost pressures, the Monetary Authority of Singapore in their latest April 2022 policy review decided to further tighten the monetary policy, which builds on the policy moves in October 2021 and January 2022, to slow the inflation momentum and help ensure medium-term price stability.

- The overall headline Inflation Expectations, after adjusting for potential component-wise behavioral biases and re-combining across components, increased to 5.7% in March 2022 from 3.1% in December 2021. This is the highest value of this behavioral bias adjusted inflation expectations since we started recording it in Quarter 1 2019. Inflation expectations rose across all components with inflation expectation for transport costs registering the highest jump to 9.0% from 4.0% in the December 2021 survey.

- We also observed that the free response behaviorally adjusted overall inflation expectations increased to 5.0% in March 2022 survey, a substantial jump from 3.0% polled in December 2021. Multiple global factors and ground realities faced by consumers seem to be the main driver of such expectation formation.

- In the March 2022 wave, continuing the analysis we embarked on in September 2020, an in-depth survey on the potential impact of Covid-19 on inflation expectations of different components of CPI was conducted. We found that the inflation expectations for most components are expected to have no disproportionate Covid-19 related impact, including the overall One-year Ahead inflation and Five-year Ahead inflation.

- Following the academic work by Alberto Cavallo of Harvard Business School (2020) and the UK Office of National Statistics (ONS), respondents were asked if there were any substantive changes to their consumption basket. In March 2022, results suggest there is no change in most of the components, exceptions being Housing and Utilities and Household Durables and Services – both of which are expected to see limited increase. This perhaps indicates that after two years since the pandemic was first declared, Singaporeans are getting used to the new normal and their component-wise monthly expenditures remain relatively stable even in the face of new waves and new restrictions. However, the recent surge in utility costs together with services related cost increase due to a tight labor market might have increased household expenditure for those components.

- Excluding accommodation and private road transportation related costs, the One-year-Ahead CPIEx core inflation expectations saw an increase from 3.1% in December 2021 to 3.9% in March 2022, charting the increase in the headline inflation expectations.

- For a subgroup of the population who owns their accommodation and uses public transport, the One-year-Ahead CPIEx core inflation expectations increased from 2.9% in December 2021 to 3.9% in March 2022. This sub-sample measurement is potentially more accurate than the full sample measurement, as the respondents truly face the MAS Core Inflation on a day-to-day basis. As expected, the level confirms the increase in the MAS Core Inflation expectations based on the polled data.

- The One-year-Ahead composite index of inflation expectations, SInDEx1, that puts less weight on more volatile components like accommodation, private road transport, food and energy related expenses polled at 4.0% in March 2022, an increase from the 3.2% figure polled in December 2021 and the highest since September 2012. It is significantly higher than the first quarter average SInDEx of 3.3% since the survey’s inception in 2012.

- In March 2022, around 73% of the survey respondents reported their belief that Covid-19’s impact on growth would be significant compared to lower proportion at 59% in December 2021. The share of survey respondents who feel that Covid-19 will have long-term impact on inflation similarly increased to around 74%, from about 59% in December 2021. Both results indicate that with the emergence of the Omicron variant, new infections albeit generally milder and push towards reopening, new waves and some continued constraints on normal life are being accepted as “the new normal” of an endemic Covid-19.

- In addition, around 12.1% of the Singaporeans polled expect a more than 5% reduction in salary in the next 12 months slightly worse compared to 10.4% in December 2021. However, the median salary increment expectation was an increase by 1-5%, an improvement from the previous poll in December 2021.

- As a measure of the tradeoff between prioritising economic growth compared to the cost to life, the so-called livelihood over life debate, the ratio was 3.3 in March 2022, higher than 2.6 in December 2021. This means for every person who prioritised life over livelihood, there are more than three who prioritised livelihood over life. This also indicates a level of divergence among Singaporeans, some who feel the economy should be reopened fully to generate some semblance of growth and creating jobs while others feel that protecting lives should be considered with utmost priority particularly given the high level of vaccination.

Figure 1: One-year-Ahead-inflation expectations: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding accommodation and private road transportation components) One-Year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDex) Survey conducted March 14-22, 2022. Source: SKBI, SMU, MAS, Department of Statistics

DBS Chief Economist and Managing Director of Group Research, Dr. Taimur Baig commented, “In line with global developments, both actual and expected inflation have picked up in Singapore. Sharp rise in food, fuel, and rents are now a global phenomenon, although the rates of increases in Singapore are more modest compared to what’s seen in the US and Europe. We think that credible policy action by the MAS will keep expectations moderate in Singapore, although the chance of expectations going back to long-term trend levels in the near-term is low. Under these circumstances of sustained price pressure, further steepening of the nominal exchange rate band by Singapore’s central bank looks justified, in our view.”

SKBI Director Professor Dave Fernandez commented, “Inflation expectations, reported inflation, and central banks are all on the move, both in Singapore and globally. Therefore, all inflation datapoints, including the ones from our survey, should be monitored closely.”

SMU Assistant Professor of Finance and founding Principal Investigator of the DBS-SKBI SInDEx Project, Aurobindo Ghosh highlighted, “It may sound like a cliché but the global inflation has been caught in a perfect storm. The reasons are manifold including disrupted reopening from the Covid-19 pandemic in major global cities like Shanghai, cyclical increase in both hard and soft commodity prices exacerbated by strife in two of the largest global exporters of food grain, continuing supply chain disruptions increasing freight time and cost, and finally, impending normalization from accommodative monetary policy which has together bought US inflation rate to 40-year highs at 8.5% in March 2022. Singapore being a small open economy is vulnerable to all these risk factors. So, it’s not surprising One-year Ahead headline and core inflation expectations jumped to over 4% for the first time in 9 years of SInDEx survey.”

“Responding to global cues, before the conflict in Ukraine, the Monetary Authority of Singapore already tightened their exchange rate based monetary policy in January 2022 and then again in April 2022 in a pre-emptive move to preclude the prospect of unhinged or unanchored inflation expectations. However, the impact of passthrough costs like rental, distribution and labour costs in a tight labour market are harder to mitigate even with the appreciating Singapore dollar against a trade weighted basket of currencies. Respondents to the survey in March 2022, corroborating academic work by Cavallo (2020), opined that their consumption basket has slightly higher expense due to energy and service costs, although impact on direct Covid-19 related expenses seem to have subsided.,” Prof Ghosh reflected.

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations increased in March 2022 to 4.8% from 3.8% in December 2021. The current polled number is higher than the first quarter average of 4.1% since the survey’s inception in 2012.

The Five-year-Ahead CPIEx core inflation expectations (excluding accommodation and private road transportation related costs) also increased to 4.6% in March 2022 from 3.6% in December 2021. Overall, the composite Five-year-Ahead SInDEx5 also increased to 4.8% in March 2022, from 3.7% in December 2021. In comparison, the current polled numbers are a bit higher than the first quarter average value (since the survey’s inception in 2011 till 2021) of the composite Five-year-Ahead SInDEx5 of 3.9%.

“The silver lining for the dark cloud of higher inflation expectations is the world attention seem to be descending on inflation and steps are being taken to mitigate inflation risks, such as the releasing of a million barrel a day from strategic petroleum reserves by the US administration to ease the pressure on oil prices. In the wake of Russian aggression in Ukraine, Western European countries are also weaning off Russian oil and gas. This also might give a strong fillip towards transitioning out of fossil fuel, even though in the short to medium term higher petroleum prices, and hence bigger incentive towards alternatives is expected. For the long term, inflation expectations also seem to be swayed by the conflict and consequent price increases. In other words, there seem to be more significant structural concerns related to the impact of geopolitics on prices. This needs to be addressed for longer term anchoring of inflation expectations. Finally, on the pandemic front, our live-vs-livelihood debate seems to signal that, with widespread vaccination and boosting, even with the more transmissible but less virulent Omicron variant, for every one person who selects life over livelihood, over three respondents support the government’s push towards opening up the economy.” Prof Ghosh commented.