Melissa Ang, a student trainer in the Citi-SMU Financial Literacy Programme for Young Adults, shared in an article that one could maximise savings on online purchases by looking for promotions, receive cashback on certain sites, and to shop at sites which offer free shipping.

Singapore, 15 October 2018 (Monday) – Singaporeans’ One-year-Ahead median inflation expectations declined to 2.88% in September 2018, as a result of the strength of the US economy, the consequent policy normalisation, and the new trade deal between US, Canada and Mexico, despite apprehensions of ongoing trade war between the two largest economies of the world - US and China. This is the research findings of the latest quarterly survey for the Singapore Index of Inflation Expectations (SInDEx) by the Sim Kee Boon Institute for Financial Economics (SKB Institute) at Singapore Management University (SMU).

Academic and practicing economists have been puzzled by the relatively low levels of inflation and inflation expectations despite several contrary factors in the global economy. First, there has been excess liquidity in the market due to one of the longest periods of accommodative monetary policy in the aftermath of the global financial crisis in 2008. Second, the ongoing normalisation of the monetary policy by the US Federal Reserve since 2015, and the consequent increase in the value of the US dollar particularly vis-à-vis the emerging market currencies. Third, despite the new trade deal with Canada and Mexico, the current US administration’s imposition of trade tariffs and threatened renegotiation of existing multilateral trade agreements, as well as the ensuing retaliatory measures from other major economies particularly China. Fourth, the global uncertainty with the stalled BREXIT negotiations and a possibility of a “no-deal” BREXIT; and in general, the emergence of populist and protectionist political movements in major European economies. Finally, a cyclical upturn in the commodity market with a surge in prices of commodities including crude oil. However, despite all these headwinds to trade, global inflation has not spiked. The International Monetary Fund (IMF), in outlining the challenges to monetary policy particularly in emerging markets, has highlighted that domestic factors rather than global ones might be responsible for muted inflation in most emerging economies.

As a way forward for stabilising global inflation outlook in an era of normalisation of monetary policy particularly in the US, the IMF has said in its October 2018 World Economic Outlook report, “… further improvements in the extent of anchoring of inflation expectations can significantly improve economic resilience to adverse external shocks in emerging markets. Anchoring reduces inflation persistence and limits the pass-through of currency depreciations to domestic prices, allowing monetary policy to focus more on smoothing fluctuations in output…”

In Singapore, on the domestic front, we note some factors that have had an impact on inflation expectations. First, inflation in the major components of the CPI-All Item basket has generally increased. The year-on-year decline in accommodation related expenses have moderated, while the decline in private road transport costs have somewhat stabilised. In addition, food and retail inflation has picked up slightly year-on-year. However, services inflation has eased. Finally, improving labour market conditions might not have impacted domestic prices as much through pass-through costs.

In summary, after considering the counterbalancing impacts of a normalisation of monetary policy, trade tensions and the impact on domestic prices, Singaporeans who responded to the SInDEx survey felt that there is a significant decline in inflation expectations both in the medium term and the long term.

Currently into its eighth year, SInDEx was developed at the Sim Kee Boon Institute for Financial Economics by SMU Professors Aurobindo Ghosh and Jun Yu. The SInDEx survey, supported and implemented by Agility Research & Strategy, a leading Asian consumer insights and strategy firm with a large client base of government and private sector clients, is derived from an online survey of around 500 randomly selected individuals representing a cross section of Singaporean households. The online survey helps researchers understand the behaviour and sentiments of decision makers in Singaporean households. The quarterly SInDEx survey has yielded two composite indices, median SInDEx1 and median SInDEx5. Medians are less affected by outliers in survey-based methods, hence median SInDEx is used for the current release.

In the latest and the twenty-nineth wave of the SInDEx survey conducted in September 2018, consumers shared their views on expectations of inflation-related and asset management related variables over the medium term (One-year-Ahead) to long term (Five-year-Ahead).

In September 2018, the quarterly SInDEx survey showed that the median One-year-Ahead headline inflation (or CPI-All Item inflation) continued a downward trend to 2.88% from 3.11% recorded in June 2018, slightly lower than its recent third quarter average of 2.91%. Additionally, compared to the historical median headline inflation expectations (since the inception of SInDEx in September 2011) average of 3.41%, current One-year-Ahead median headline inflation is significantly lower.

In the June 2018 SInDEx survey, the team at SMU together with the Behavioral Insights Team (BIT, originally part of the United Kingdom Cabinet Office) and the Monetary Authority of Singapore polled individuals on the constituents of CPI-All item inflation expectations while providing them with more current economic information to facilitate informed responses. This research was conducted to sharpen the SInDEx survey questions to accommodate for potential behavioural biases in the individuals’ responses.

Since the updated SinDEx survey was launched in June 2018, the median one-year-ahead inflation expectations of some of the components of CPI-All Item inflation such as Food, Transport, Housing & Utilities and Healthcare were also recorded. Compared to June 2018, the September 2018 survey revealed significant reductions in inflation expectations of these major components of the CPI basket. Food inflation remained unchanged at 2%; Transportation inflation pared to 2.1% from 3%; Housing & Utilities inflation also corrected to 2% from 3%, while Healthcare inflation remained unchanged at 3%.

The overall median Headline Inflation Expectations, after adjusting for potential behavioural biases, was at 2% in September 2018, unchanged from the June 2018 survey. This also suggests that the median inflation expectations seem to be “anchored” fairly well despite various short-term uncertainties of the global economy, including trade tensions, policy normalisation and continued strength in recovery of oil and other commodity prices.

Excluding accommodation and private road transportation related costs, the One-year-Ahead median Singapore core inflation expectations was recorded at 2.92% in September 2018, substantially lower than the June 2018 survey of 3.29%. For a subgroup of the population who own their accommodation and use public transport, the One-year-Ahead median Singapore core inflation rate also dropped significantly to 2.86% in September 2018 from 3.19% polled in June 2018. This subgroup’s expectations of core inflation closely resembles the Singapore Core Inflation Expectations, as unlike the general population they are not exposed to private road transportation or accommodation expenses. These results suggest that there seems to be a significant downward correction in the perception of future overall price changes representing the Singapore core inflation rate that excludes housing and private road transportation as a possible early impact of policy tightening.

The research team also polled the respondents for their One-year-Ahead expectations of inflation after excluding accommodation and public road transportation expectations. The respondents were provided with further information of current and past core inflation rates. After adjusting for some potential behavioral biases, the One-year-Ahead inflation expectations, excluding accommodation and private road transportation, was polled at 2%, this was unchanged from a similar survey done in June 2018, suggesting some degree of anchoring of inflation expectations despite short term global uncertainties.

In summary, the One-year-Ahead median Singapore Index of Inflation Expectations (Median SInDEx1), a composite weighted index of One-year-Ahead median inflation expectations, declined to 2.91% in September 2018 from 3.20% in the June 2018 survey, a nearly 0.3% drop. The median SInDEx1remained lower than its historical average value of 3.41% since the survey’s inception in September 2011. SInDEx1 was constructed as a plausible alternative and more stable measure of inflation expectations by putting lower weightage on the more volatile and policy- sensitive components such as accommodation, private transportation, food and energy. Median SinDEx1 is also less adversely affected by extreme values, unlike the original mean.

SMU Assistant Professor of Finance Aurobindo Ghosh, who is the Principal Investigator of the SInDEx Project highlighted, “Inflation expectations of Singaporeans surveyed seem to embody the dichotomy faced by central banks in most developed and major emerging markets which has to import commodities like oil. On one hand, steady and strong US growth and lowest unemployment in nearly five decades prompted the US Federal Reserve to implement a faster than expected normalisation of the monetary policy. This has resulted in a run-up in the value of the US dollar against most currencies. This might prompt other central banks to follow suit and tighten their own monetary policy, as well keep pace with a surging US dollar. On the other hand, with a muted inflation and the need to give a boost to domestic producers, central banks might also resort to a more deliberate approach and keep their policy more accommodative. Monetary policy tightening through increase in interest rates often takes effect in as long as 18 months, hence tightening the policy too soon might risk an inversion or flattening of the yield curve which means short terms rates are almost equal to or greater than long term rates which is often a harbinger of incoming downturn.”

For the longer horizon, the Five-year-Ahead median headline (CPI-All Items) inflation expectations in the September 2018 survey inched up to 3.81% from 3.77% in June 2018. The current polled number is still less than its historical average of 4.23% since the survey started in September 2011. The Five-year-Ahead median inflation expectations, after adjusting for behavioral biases, was recorded at 3% in September 2018, once again unchanged from the survey polled in June 2018.

The Five-year-Ahead median Singapore core inflation rate (excluding accommodation and private road transportation related costs) pared to 3.65 % in September 2018 from 3.69% in June 2018. Overall, the composite Five-year-Ahead median Singapore Index of Inflation Expectations (median SInDEx5) declined in September 2018 to 3.68% from 3.71% in June 2018, still substantially lower than its historical average of 4.06%.The Five- year-Ahead median inflation expectations (excluding accommodation and private road transportation), after adjusting for potential behavioural biases, was recorded at 3%, unchanged from the survey polled in June 2018. These unchanged inflation expectations, despite the price risk of global trade wars and increasing commodity prices, also indicate signs of anchoring of long-term inflation expectations.

“SMU researchers, in a joint study with the Behavioral Insights Team and the Monetary Authority of Singapore, performed a controlled trial on the impact of questionnaire design on responses, drawing from the work of behavioural scientists like Professor Richard Thaler, the 2017 Nobel laureate in Economics. The current survey accommodated for some such behavioural biases by providing current economic information for respondents to form opinions. We have identified some factors that can potentially reduce the so-called ‘anchoring bias’ that appears when respondents latch onto visible pieces of information that may influence their stated opinions about economic variables. We are addressing some of these issues in the current and future surveys through changes in the questionnaire design in addition to asking about both components and aggregate inflation expectations. Our results show that Singaporeans’ median inflation expectations, both in the medium and long term, seem to be fairly well anchored or grounded after adjusting for some behavioural biases.” Prof Ghosh added.

Commenting on the results of the Survey, SKB Institute Director Professor Dave Fernandez commented, “The SInDex results seem to me consistent with the recent decision by the MAS to increase slightly the slope of the S$NEER policy band. While core inflation is expected to edge up further in the months ahead, our survey shows that inflation expectations are well contained.”

Methodology

Two indices were created, median SInDEx1 and median SInDEx5, to measure the 1-year inflation expectations and the 5-year inflation expectations. The data for the SInDEx survey was collected online from about 500 consumers. The sampling was done using a quota sample over gender, age and residency status to ensure representativeness of the sample. Employees in some sectors like journalism and marketing were excluded as that might have an effect on their responses to questions on consumption behavior and expectations.

The Straits Times Online (pdf)

Related: Singapore inflation expectations down to 2.88% for next year: poll

The Business Times Online (pdf)

Related: Households in Singapore project that inflation for the next year would slow down

Lianhe Zaobao, p22 (pdf)

Related: Singapore Management University: Tightening policy and declining trade tensions lower Singaporeans’ inflation expectations to 2.88%

Market Screener Online (Oct 15) (Pdf)

Market Screener Online (Oct 15)

Related: Singapore inflation expectations for 2019 falls to 2.88%

Singapore Business Review Online (pdf)

Singapore Business Review Online

Related: Singapore inflation expectations down to 2.88% for year ahead: poll

Share Investor Online (Oct 15) (Pdf)

Share Investor Online (Oct 15)

Related: Households in Singapore project that inflation for the next year would slow down

Channel 8 Online (Oct 15) (pdf)

Channel 8 Online (Oct 15)

[Feature Photo: (L-R) SKB Institute Director, Prof Dave Fernandez, and Principal Research Associate, Tom Lam at the IMF-World Bank Annual Meetings in Bali, Indonesia.]

SKB Institute Director, Prof Dave Fernandez, and Principal Research Associate, Tom Lam, attended the IMF-World Bank Annual Meetings in Bali, Indonesia. The Annual Meetings are a flagship event for a broad spectrum of global participants, from central bankers to private sector representatives, to discuss global challenges. The meetings are routinely held in the US (Washington, DC) for two successive years, but rotate to another member country in the third year. Singapore and Tokyo were the two Asian cities that hosted the meetings in 2006 and 2012, respectively.

Some of the dominant themes from the conference include the future path of Federal Reserve (Fed) rate hikes and their impact on global markets, ongoing trade tensions between the US and China, lingering uncertainty in Italy, structural headwinds and tailwinds in Asia and the direction of oil prices.

Tom Lam interacted with central bank officials from the US and emerging markets, including a representative from the Bank for International Settlements. Notwithstanding the uncertainty in equity markets recently, the general takeaway from Tom’s interaction with Fed officials was that the current market environment is generally “okay” and manageable. But policymakers also acknowledged that the prolonged period of hand-holding by the Fed thus far would increasingly be less likely going forward.

While financial markets are still leaning toward one more rate hike in December, essentially totaling four 25 basis points rate increases in 2018, the market pricing for 2019 has been less aggressive. Many Wall Street forecasters have been expecting three to four rate increases next year, with the latest Federal Open Market Committee median “dot plot” highlighting three moves. But Tom’s view is that the market might be closer to reality, with the possibility of only a couple of rate hikes in 2019. Although Tom does not anticipate inflation to be a problem in 2019, risk management considerations might compel the Fed to lengthen the gradual tightening cycle.

Prof Dave presented his view on financial stability and risks in Asia to a group of about 200 emerging markets (EM) investors at a conference hosted by JPMorgan. Other presenters on the same panel were the Chief Economist of the European Stability Mechanism and the former Board Member of the Deutsche Bundesbank, who both focused on Europe. With respect to our region, Prof Dave observed that EM Asia asset prices had taken a beating in recent months and may have overshot, relative to fundamentals.

Blockchain, crowdfunding, cashless payment and robo advisory are no longer esoteric concepts. Fintech innovations have also been increasingly incorporated into our daily lives. In addition, Fintech is changing the start-up landscape. How can the youths equip themselves with necessary skillsets for jobs of the future? Why does Fintech matter to all entrepreneurs?

To answer these questions, the Sim Kee Boon Institute for Financial Economics at SMU and Citi Singapore, through the Citi-SMU Financial Literacy Programme for Young Adults (‘Programme’), organised its 5th symposium on 20 September 2018.

Themed “Fintech: Empowering Youth and The Future of Work”, some 300 participants, of which about 240 students are from ITE, Polytechnics and SMU, and the rest from government agencies and partner organisations, attended the symposium.

Mr Zaqy Mohamad, Minister of State, Ministry of National Development & Ministry of Manpower, graced the event as the guest-of-honour, and delivered a speech.

In his speech, Mr Zaqy Mohamad shared how the CPF system works. He said, “The CPF system is here to support you. It has helped the vast majority of Singaporeans to own the homes we live in and will do likewise for you. It helps us to take care of most of our big medical expenses. Our individual hard work, coupled with our employers’ contributions and the interest paid by the CPF Board on our savings, helps us build up a sizeable nest egg and a retirement income for life.”

Mr Zaqy also highlighted some of the risks that arise from individual decisions. First, the rise of the gig economy in which some of the work arrangements make a person more like a contractor than an employee and so do not come with CPF contributions. This means the individual has nothing to fall back on when he wants to buy a house, falls very sick, or has to retire without family support. Second, taking risks with property purchases, by either stretching one’s budget to the limit or speculating in the hope of a big upside gain. Thirdly, when CPF members put their hard-earned CPF savings in investments they neither have the knowledge nor time to manage, the results are not always happy. He urged the audience to learn more about the CPF system and how it can work better for them, so that they can have the peace of mind to pursue their life goals.

Addressing the youths in the audience, SMU Provost Professor Lily Kong said, “Budding professionals like yourself have to start thinking about how to plan and prepare for the vagaries of future opportunities, and be prepared like an entrepreneur to take risks and manage your finances in order to be part of the financial ecosystem. We cannot address the issue of financial inclusion unless we improve financial literacy, particularly among youths. Financial literacy is thus foundational to financial empowerment and financial freedom.”

Mr Adam Rahman, Head of Corporate Affairs, Citi Singapore and ASEAN, said “The rapid digital transformation of the financial services sector makes collaboration between industry and educational institutions even more important today. I am optimistic that efforts such as the Citi-SMU Financial Literacy Program for Young Adults will give rise to a new generation of entrepreneurs and executives well prepared to thrive in the future.”

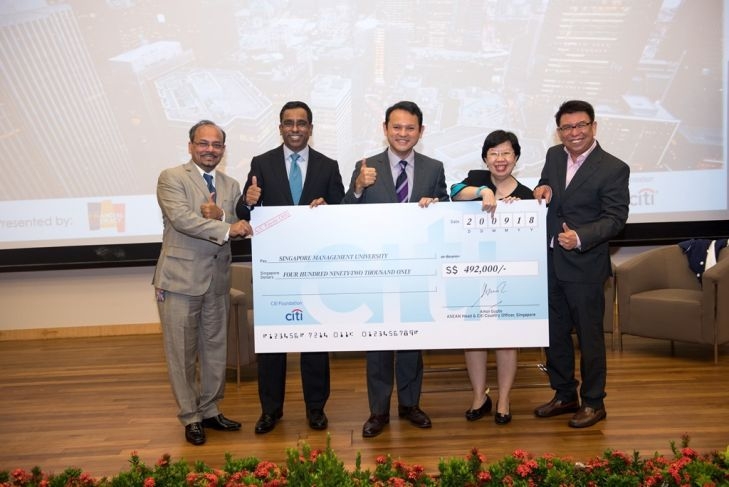

At the symposium, Citi Foundation presented a cheque of S$492,000 to SMU for the continuation of the Citi-SMU Financial Literacy Programme for Young Adults in 2019. Since the Programme’s inception in 2012, Citi has cumulatively contributed about S$3 million to the Programme.

Another highlight of the symposium is the FinLitChallenge 2018 Award Presentation. This is a competition for students from ITE, Polytechnics and SMU which challenges them to spread financial literacy knowledge to their peers through creative and engaging ways. The theme of this year’s challenge is the potential and risks of cryptocurrency.

For the SMU Category, Team Decrypto – comprising Tan Jia Hao, Ng Zheng Nan and Tan Jia Wen from SUTD-SMU Dual Degree Programme in Technology and Management – was chosen as the winner in recognition of their creativity in repackaging the complex topic of cryptocurrency into an easy-to-understand infographic.

For ITE/Polytechnic Category, Team Sole Survivors from ITE College West – comprising Stephanie Joshua, Aw Wei Lun and Larah Villaviray – was chosen as the winner in recognition of their hard work, teamwork and creativity in completing a three-segment financial literacy challenge, i.e. Instagram challenge, an Amazing Race and a Facebook Video Competition.

The symposium also had two panel discussions. The first panel, moderated by Mr Perry Kwan, President of Citi-SMU Financial Literacy Club, comprised of Ms Anna Haotanto, CEO of The New Savvy; Assistant Professor Aurobindo Ghosh, Principal Investigator, Citi-SMU Financial Literacy Programme for Young Adults, SMU; Mr Kenneth Lou, Co-Founder & CEO of Seedly. The panel discussed issues such as how Fintech can play a positive role in progressing Singapore’s growing start-up ecosystem, and how professionals and entrepreneurs can equip themselves with necessary skillsets to derive maximum benefit from FinTech.

The second panel was moderated by Mr Freddy Lim, Co-founder & Chief Investment Officer of Stashaway. The panel members were Ms Abigail Ng, Executive Director, Corporate Finance & Consumer Department / MoneySENSE, Monetary Authority of Singapore; Mr Edmas Neo, Executive Director, Action Community for Entrepreneurship; and Mr Fonzarelli Ong, Head, Digital Banking, Citibank Singapore Limited. They discussed some of the risks of Fintech, how consumers and businesses can manage those risks, and why Fintech plays a very important role in Singapore’s ambition of becoming a Smart Nation.

Since its launch in 2012, the Programme has trained more than 400 student trainers from SMU, Polytechnics and ITE, who have in turn reached out to more than 20,000 young adults from ITE, Polytechnics, Association of Muslim Professionals, Chinese Development Assistance Council and many others, to teach them about money management and responsible financial behavior.

This year, the Programme has achieved three milestones. They are:

My Money @ Campus - MoneySENSE/Monetary Authority of Singapore and the Association of Banks in Singapore have commissioned SMU and Citi-SMU Financial Literacy Programme for Young Adults to conceptualise and run the inaugural My Money @ Campus series in the polytechnics from May to July 2018. Student trainers from SMU and the five Polytechnics have worked closely with more than 250 student volunteers from SMU and the polytechnics reaching out to more than 7,000 students.

Financial Literacy Programme for SMU Undergraduates - SMU is the first university in Singapore to offer a financial literacy programme to its freshmen through interactive sport activity. The Citi-SMU Financial Literacy Programme for Young Adults has organized financial literacy human foosball as part of SMU Freshmen Orientation which is organized for all SMU freshmen.

Smoolah - a Virtual Reality based Financial Literacy Mobile Game. The Programme is developing a virtual reality based mobile game to share financial concepts such as saving, budgeting, investing, insurance and Fintech in a fun and interactive way.

The SKB Institute hosted Federal Reserve Bank of St. Louis President James Bullard on Monday 8 October 2018, where he delivered the OMFIF Foundation City Lecture with remarks titled “Some Consequences of the U.S. Growth Surprise". SKB Institute Director and LKCSB Professor of the Practice of Finance, Dave Fernandez, welcomed the over 140 guests and later led the Q&A session, together with Mark Burgess, former President and CEO of Australia’s Future Fund.

St Louis Federal Reserve Bank President James Bullard was in Singapore on 8 October 2018 to speak at a lecture organised in partnership with SMU’s Sim Kee Boon Institute for Financial Economics and the Official Monetary and Financial Institutions Forum Foundation. The lecture was held at SMU.

The Business Times, p3

The Business Times Online

Related: Emerging markets 'as prepared as they can be' for U.S. rate moves: Fed's Bullard

Reuters Online (Oct 8)

Bullard Says U.S. Growth Depends on Productivity Picking Up

Bloomberg Online (Oct 8)

Emerging markets 'as prepared as they can be' for U.S. rate moves: Fed's Bullard

Investing Online (Oct 8)

Emerging markets 'as prepared as they can be' for U.S. rate moves - Fed's Bullard

Nasdaq Online (Oct 8)

Emerging markets 'as prepared as they can be' for U.S. rate moves, Bullard says

STL Today Online (Oct 8)

Fed’s Bullard: Emerging markets prepared for US rate moves

The Star Online (Oct 8)

The SKB Institute hosted Federal Reserve Bank of St. Louis President James Bullard on Monday 8 October where he delivered the OMFIF Foundation City Lecture with remarks titled “Some Consequences of the U.S. Growth Surprise.” SKB Institute Director and LKCSB Professor of the Practice of Finance, Dave Fernandez, welcomed the over 140 guests and later led the Q&A session, together with Mark Burgess, former President and CEO of Australia’s Future Fund. In his talk, Bullard noted that “The U.S. growth surprise has been a factor in allowing the FOMC to normalize its policy rate along a projected path, with attendant consequences for global financial markets.” Bullard also pointed out that growth surprised outside the U.S. and that in 2017, “relatively speaking, the growth surprise was larger outside the U.S,” he said. This coincided with a period of relative US dollar weakness. In 2018, the U.S. continued to surprise on the upside while other major economies look unlikely to do as well as they did the year before, coinciding with a period of relative U.S. dollar strength.

On whether the U.S. growth surprise can continue, Bullard was cautious and pointed out that the U.S. potential growth rate is widely thought to be relatively low, in part due to demographics. “Accordingly, the U.S. will likely need faster productivity growth in order to maintain current real GDP growth rates,” he said. Such a switch to a high state for labor productivity growth could happen, “but it has not materialized so far,” he added

During the Q&A, Prof. Dave asked about the impact of monetary policy divergence (the FOMC raising rates while other central banks, like China, are easing) on U.S. dollar strength, and Bullard focused his answer on the importance of policy surprises. In the case of the Fed, the market had been skeptical that the FOMC would act, so needed to reprice when it became clear that they would. In response to other questions about the impact of U.S. policy on other countries, Bullard said, “Big picture, emerging markets are as prepared as they can be for changes in U.S. monetary policy.”

As with all speeches by Fed officials, Bullard’s remarks at the SKB Institute were immediately posted on the St. Louis Fed website. The press release and his slides can be found at the link below:

Photos are available for viewing here.

SUBSCRIBE TO THE SKBI MAILING LIST*

Get updates on SKBI news and forthcoming events.

*Please note that upon providing your consent to receive marketing communications from SMU SKBI, you may withdraw your consent, at any point in time, by sending your request to skbi_enquiries [at] smu.edu.sg (subject: Withdrawal%20consent%20to%20receive%20marketing%20communications%20from%20SMU) . Upon receipt of your withdrawal request, you will cease receiving any marketing communications from SMU SKBI, within 30 (thirty) days of such a request.