[L-R] Martin Steinfeld (University of Cambridge), Marianna Kozintseva (Turning Point Macro) , olene Lin (National University of Singapore), Rajiv Lall (Singapore Management University) at the session,"Best Practices in Boardroom Climate Action - Workshop A (Strategy and Leadership)" during the International Conference on ESG and Climate Governance held in Singapore.

|

By Dr Marianna Kozintseva, Founder/CEO, Turning Point Macro, Visiting Faculty, Singapore Management University, Sim Kee Boon Institute for Financial Economics. Prepared Remarks for June 28, 2023, Best Practices in Boardroom Climate Action - Workshop A (Strategy and Leadership), at the International Conference for ESG and Climate Governance. |

Why the War in Ukraine Matters for ESG and Climate Governance

Ladies and Gentlemen,

It is a real pleasure to be here today and to address the topic that has kick-started our conference: the implications of the war in Ukraine for ESG and Climate Governance.

We have already heard from the Director of Sim Kee Boon Institute for Financial Economics, Professor David Fernandez, how a military aggression is an expression of ultimate disdain for standards of good international governance1.

And we have also heard from Ambassador of Ukraine to the Republic of Singapore Her Excellency Kateryna Zelenko how the war in Ukraine is not, in fact, limited to just Ukraine and has no geographic boundaries2.

These factors put the war in Ukraine into the forefront of ESG debates.

One picture is worth a thousands words. So I would like to share this picture with you (Picture 1). It is a satellite image from Maxar Technologies taken on June 6, 20223 . It shows Ukrainian fields peppered with hundreds of artillery craters. This is what the effect of the war in Ukraine on the environment looks like from up close.

Picture 1

Ukrainian fields peppered with hundreds of artillery craters, 49.009, 37.308

Source: Maxar Technologies

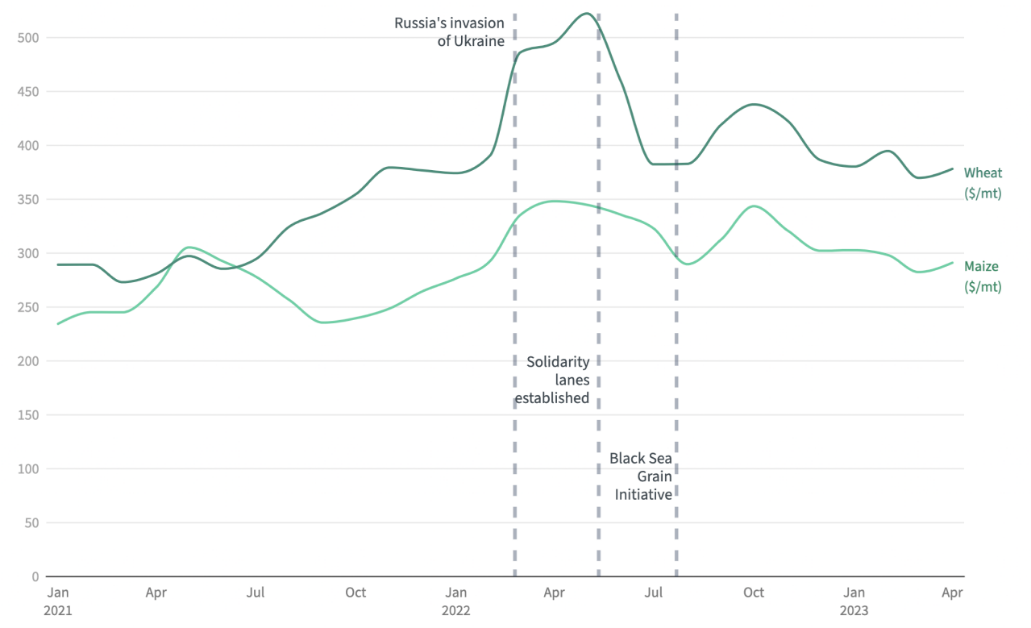

And I would also like to share with you this Figure (1), which shows what war in Ukraine did to the prices of wheat and maize, that are the staple food crops for millions around the world4.

Figure 1

Benchmark prices for wheat and maize, January 2021- April 2023

Source: European Council, Council of the European Union, The World Bank

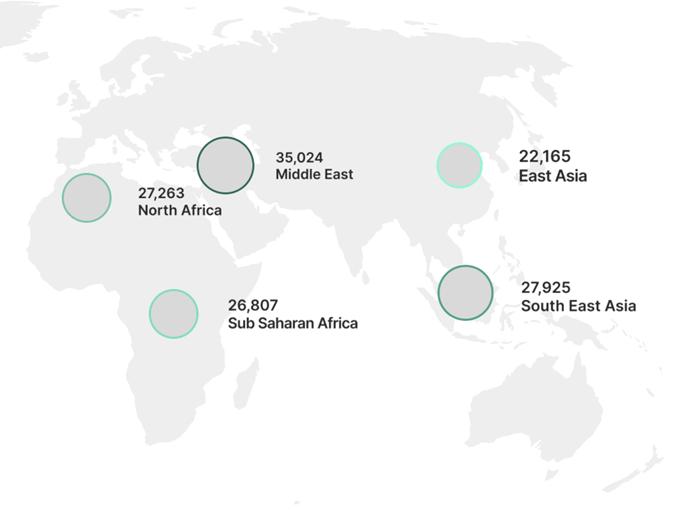

The prices of both grains rose significantly from the start of Russia’s invasion until May of last year, when solidarity lanes were established. These higher prices translated into higher inflation and greater economic hardships for nations that are the net wheat and maize importers5, worsening the food crisis in vulnerable areas of Middle East, Asia and Africa (Figure 2).

Boardroom Risks that the War in Ukraine Creates

Aside from creating risks for food security, as well as energy security, and climate security, the war in Ukraine also creates risks in the boardrooms.

These risks arise when companies fail to set up explicit policies on how to address environmental, social and governance challenges posed by the war.

Figure 2

Top Net Wheat Importers, 2021/2022, Thousands Metric Tons

Source: United States Department of Agriculture, Turning Point Macro

Such risks can be grouped into three broad categories:

- A loss of public trust;

- Exposure to primary and secondary sanctions;

- Potential rating agency downgrades.

A loss of public trust arises due to disappointment by either shareholders or stakeholders in company action - or inaction. Such loss of trust - quantified via a sentiment analysis - can lead to a drop in company’s stock price, an increase in stock price volatility and generate numerous domino effects, from changing company’s ability to borrow, to its inclusion or exclusion in various indices, to loss of key customers or suppliers.

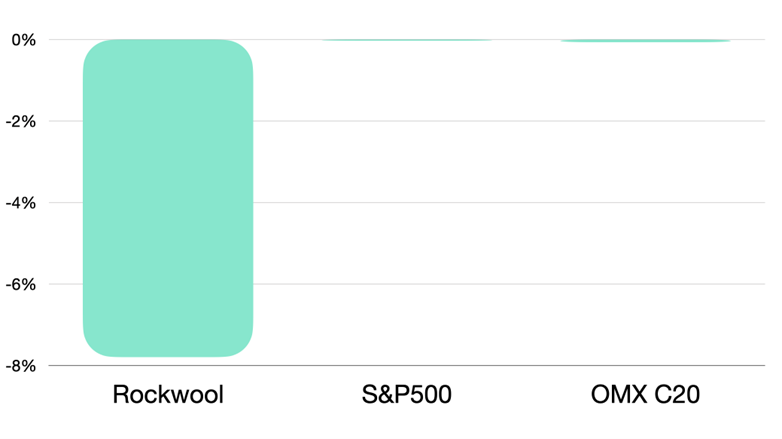

For example, on February 24, 2023, a scandal broke in Denmark when an investigative media outlet Danwatch, together with media outlet Ekstra Bladet, reported that products made by a publicly traded Danish company Rockwool were used in military projects in Russia between 2015 and 2020. Specifically, the report has asserted that “An examination of contracts in the Russian government's official procurement database shows that Rockwool's Russian partners have, in at least 21 cases, supplied Rockwool products worth a total of 123 million rubles (approximately 11.5 million kroner) to shipyards carrying out large orders on behalf of the Russian Ministry of Defense.” 6

Rockwool’s contracts in question covered the period before Russia’s invasion of Ukraine in February 2022 and the EU sanctions did not prohibit imports and exports of stone wool (Rockwool’s main product) to Russia between 2014 and 2022. Despite that, on February 28, 2023, the Danish Business Authority publicly announced an inquiry regarding Rockwool’s Russia-related business activities, including questions relating to ownership structures as well as potential sanctioned sales and sales involving the Russian military7.

As a result, shares in Rockwool fell by 7.79% on February 28, with 9x increase in trading volume vs the previous day. S&P500 index declined by only 0.3% on February 28 and Denmark’s benchmark OMX20 index declined by only 0.69%, making Rockwool’s underperformance attributable solely to the scandal surrounding their Russian connection (Figure 3)8.

An actual exposure to sanctions is another risk.

To disrupt Russia’s ability to wage war against Ukraine, the OFAC - the Department of the Treasury’s Office of Foreign Assets Control - and the BIS - the Department of Commerce’s Bureau of Industry and Security - have imposed unprecedented export controls and sanctions globally9. According to Voice of America, over 2,400 international entities and individuals have been sanctioned between February 2022 and March 202310.

Figure 3

Rockwool A/S Class B Shares (Local Currency Terms) vs S&P 500 and OMX Copenhagen 20 Performance, February 28, 2022

Source: Google Finance, Turning Point Macro

In parallel, the US Department of Justice has matched these export controls and sanctions with equally unprecedented enforcement efforts. Running afoul of them means risking to become a target of regulatory action, administrative enforcement action, or criminal investigation by the DOJ11.

Finally, there is a matter of a rating, both a traditional credit one and an ESG one. For now, rating downgrades have been limited chiefly to Russia as a sovereign as well as to the Russian corporate entities.

With every passing day of the war and with every new round of sanctions, however, chances that a rating action may be taken against a non-Russian company that is still doing business in or with Russia are increasing.

Several institutions maintain public databases of such companies. Two of the most known databases the Yale School of Management Chief Executive Leadership Institute database and the Kyiv School of Economics Stop Doing Business with Russia database.

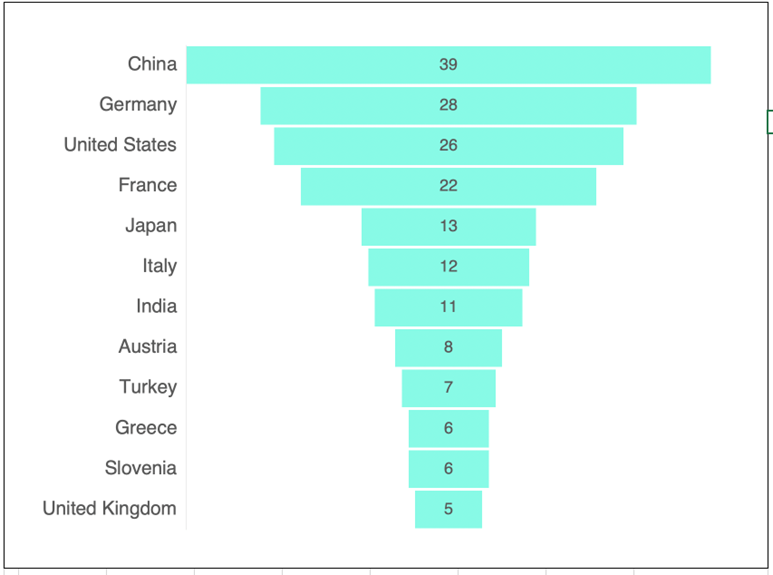

Yale database tracks activities in Russia by the top 1,200 companies globally and buckets the companies into 5 categories: those, which withdrew from Russia, those, which have suspended their activities, those that scaled back, those that are buying time and, finally, those that are digging in (Figure 4)12.

Figure 4

Number of Companies That Are Conducting Business with Russia as Usual (“Digging In”), By Country, 5 Companies or More

Source: Yale School of Management Chief Executive Leadership Institute, Turning Point Macro

Kyiv tracks 3,326 global companies and buckets them into six categories: 1) those that sold its business/assets or its part of the business to a local partner and left the market (“exit completed”), 2) those that have completely halted Russian engagements or are exiting Russia (“clean break”), 3) those that are temporarily curtailing operations while keeping return options open (“pause operations”), 4) those that are scaling back some business operations while continuing others (“reducing activities”), 5) those that re -postponing future planned investment/development/marketing while continuing substantive business (“hold off investments”) and 6) those that continue operations in Russia13.

There are 215 companies in the Yale’s “digging in” category, and these could be potentially most at risk for rating action, especially within an ESG category, if or when it is to come.

An Action Plan for Non-Executive Directors Regarding the War in Ukraine

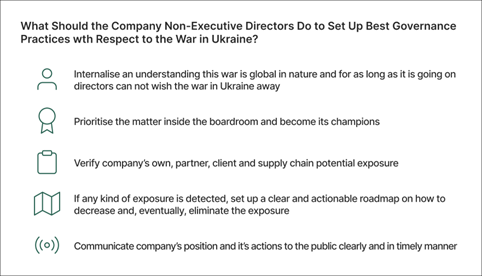

What should the company non-executive directors do to de-risk institutions they are tasked with shepherding and to set up best governance practices with respect to the war in Ukraine?

Here is one simple, 5-step action plan (Picture 2).

First, internalise an understanding this war is global in nature and, for as long as it is going on, directors can not wish the war in Ukraine away.

Second, prioritise the matter inside the boardroom and become its champions.

Third, verify company’s own, partner, client and supply chain exposure to the war in Ukraine - otherwise the risk may be there, however, a company may not know that the risk exists.

Fourth, if any kind of exposure is detected, set up a clear and actionable roadmap on how to decrease and, eventually, eliminate the exposure.

Fifth, communicate company’s position and its actions to the public clearly and in timely manner.

Given that you are all here, attending this workshop, I would say that individuals present have already taken the step number one.

And, as we all know from Laozi’s Dàodé Jīng, a single step is how a journey of a thousand miles begins (Image 3).

Thank you for your attention.

Image 2

An Action Plan for Company Directors Regarding the War run Ukraine

Source: Turning Point Macro

Image 3

A Journey of A Thousand Miles

Image Credit: Pixabay: Ronny Overhate, Ketapang, Indonesia. Quote Source: Laozi.

1 David Glenn Fernandez, The Introductory Note on SMU Guest-of-Honour, H.E Kateryna Zelenko, 26 June 2023, https://skbi.smu.edu.sg/news/2023/jun/26/dave-fernandez-introduces-he-kateryna-zelenko-guest-honour-keynote-international.

2 Kateryna Zelenko, The Guest of Honour Keynote, International Conference for ESG and Climate Governance, 26 June 2026, https://skbi.smu.edu.sg/news/2023/jun/26/guest-honour-keynote-geopolitics-climate-change-and-transition-net-zero-ukraine.

3 Washington Examiner, Victor I. Nava, June 8, 2022, “Satellite images show Ukraine peppered with artillery strike craters.”

4 European Council, Council of the European Union, Infographic - Ukrainian grain exports explained, https://www.consilium.europa.eu/en/infographics/ukrainian-grain-exports-explained/, Retrieved: 28 June 2023

5 United States Department of Agriculture, Foreign Agricultural Service, Grain: World Markets and Trade, June 2023, https://apps.fas.usda.gov/psdonline/circulars/grain.pdf

6 Danwatch, 24 February 2023, “Rockwool has made millions supplying Putin's war machine,” https://danwatch.dk/en/rockwool-in-rusland-have-made-millions-supplying-putins-war-machine/.

7 Rockwool, 1 March 2023, ROCKWOOL reaction to Danish Business Authority letter regarding activities in Russia, https://www.rockwool.com/group/about-us/news/2022/rockwool-reaction-to-danish-business-authority-letter-regarding-activities-in-russia/

8 On March 28, the Danish Business Authority has predictably concluded that Rockwool did not violate any Russia-related sanctions and has closed the case. See: Rockwool, 28 March 2023, Danish Business Authority closes the case: ROCKWOOL did not violate any Russia-related sanctions, https://www.rockwool.com/group/about-us/news/2023/2023-03-28-danish-business-authority-closes-the-case-rockwool-did-not-violate-any-russia-related-sanctions/.

9 Department of Commerce, Department of the Treasury, and Department of Justice Tri‐Seal Compliance Note, 2 March 2023, https://www.justice.gov/file/1571336/download?utm_medium=email&utm_source=govdelivery

10 Voice of America, Masood Farivar, 6 March 2023, US Warns About Increasing Use of Intermediaries to Evade Russia Sanctions, https://www.voanews.com/a/us-warns-about-increasing-use-of-intermediaries-to-evade-russia-sanctions/6992824.html.

11 Department of Commerce, Department of the Treasury, and Department of Justice Tri‐Seal Compliance Note, 2 March 2023, https://www.justice.gov/file/1571336/download?utm_medium=email&utm_source=govdelivery

12 Yale School of Management, 23 June 2023, Over 1,000 Companies Have Curtailed Operations in Russia—But Some Remain, https://som.yale.edu/story/2022/over-1000-companies-have-curtailed-operations-russia-some-remain ; Yale School of Management, Chief Executive Leadership Institute, Yale CELI List of Companies Leaving and Staying in Russia, https://www.yalerussianbusinessretreat.com/.

13 KSE Institute, Leave Russia, Stop Doing Business with Russia Database, Accessed on June 28, 2023, https://leave-russia.org/?flt[140][eq][0]=494&flt[147][eq][0]=9057&utm_referrer=https://leave-russia.org/?flt[140][eq][]=494&utm_referrer=https://leave-russia.org/?flt[140][eq][0]=494&flt[147][eq][]=9057&utm_referrer=https://leave-russia.org/?flt%5B140%5D%5Beq%5D%5B%5D=494.

About the International Conference on ESG and Climate Governance

The inaugural International Conference on ESG and Climate Governance brings together academic experts, practitioners, and board directors from six continents, across disciplines and industry sectors to address theoretical and practical challenges to climate action across the world by drawing on academic expertise to develop impactful solutions which can be put to practice. View the conference page here.

About Dr Marianna Kozintseva

Marianna Kozintseva's business interests span finance, defense and technology. Her work with governments, institutional investors and corporates while at Bear Stearns, JP Morgan and Morgan Stanley deepened her appreciation for challenges facing the emerging markets - as well as the enormous potential emerging markets hold. She have began her career as a defense analyst at RAND, where she helped design the path for NATO enlargement. Afterwards, while working on her PhD dissertation at Johns Hopkins University-SAIS, she fell in love with finance, which led to a successful career on Wall Street as an emerging markets strategist. Now Dr Kozintseva is on a third leg of her career journey - directly advising clients and working on developing a mobile FinTech platform. She is passionate about making the world a greener, more sustainable place and is privileged to be contributing to ESG initiatives at Singapore Management University.