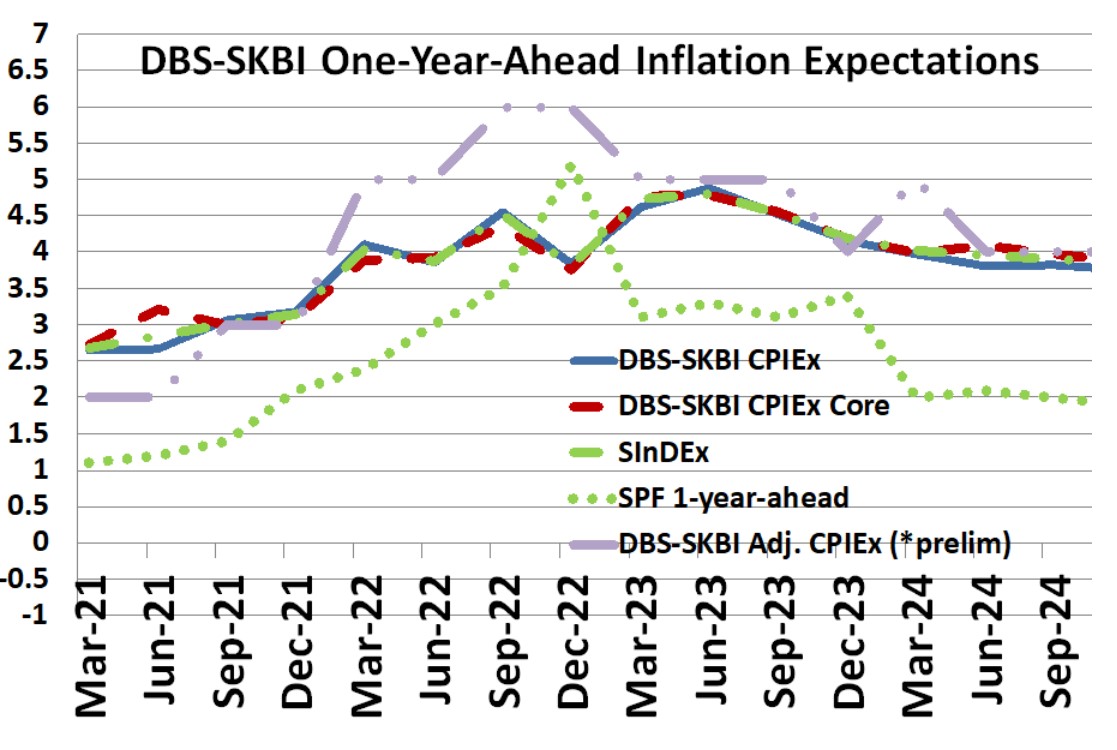

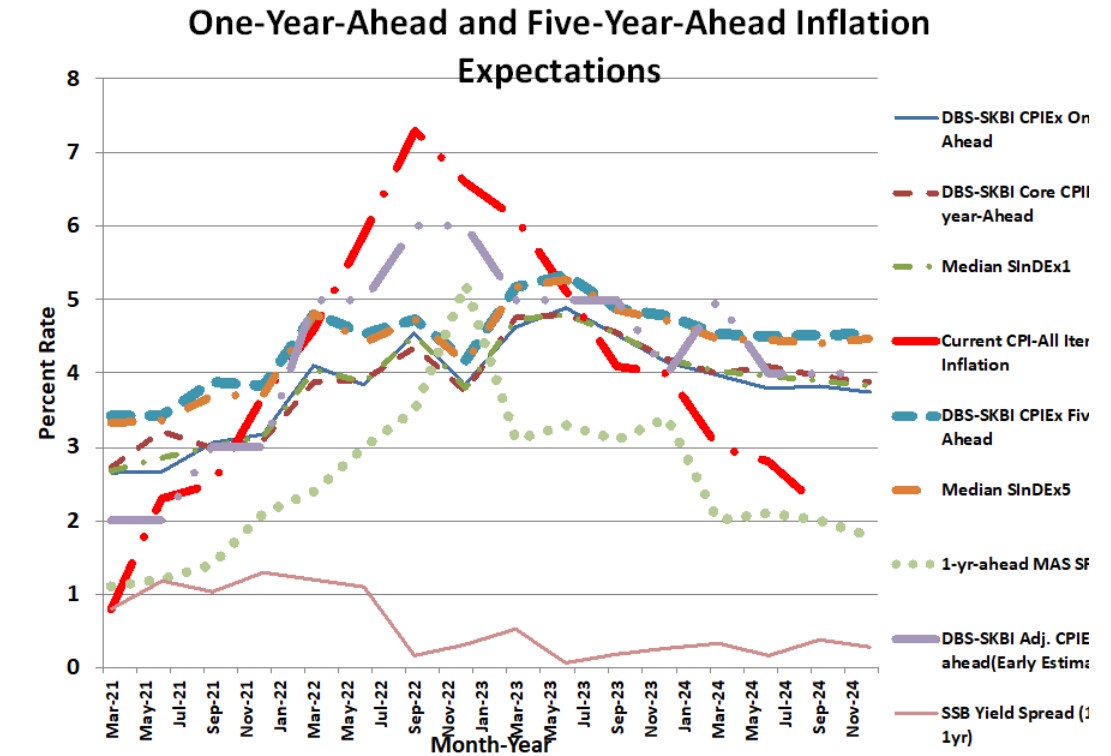

Figure 1: One-year-Ahead inflation expectations: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding Accommodation and Private Transportation components) One-year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDEx) Survey conducted on a representative sample of Singaporean residents between 16 December and 23 December 2024. Source: SKBI, SMU, MAS-MTI, Department of Statistics DBS Bank Chief Economist and Managing Director of Group Research, Dr Taimur Baig, commented, “After several years of high inflation, the second half of 2024 brought substantial price relief to Singapore’s residents. With a substantial rally of the US dollar (USD) in recent months, Singapore’s inflation outlook might be a bit more challenging on the margin, but there are mitigating circumstances. Other currencies have sold off against the USD as well, supporting the SGD NEER index. Inflation expectations are largely stable, albeit on the high side. Trump 2.0 and impending tariffs are looming over Singapore and other trade-intensive nations.” Dr Aurobindo Ghosh, Assistant Professor of Finance at Singapore Management University (SMU), the creator and the founding Principal Investigator of the Quarterly DBS-SKBI SInDEx Project, observed, “Having recovered from a once-in-a-century pandemic, some of the vestiges of the pandemic-era measures like lifestyle changes seem to be persistent which might have some lingering impact on cost-of-living. This has been exacerbated by episodes of supply chain disruption, fuel price surges, protectionist policies owing to geopolitical bifurcation between the two largest economies and strategic alliances, and continued conflicts between Hamas-Israel or Ukraine-Russia, though some light seems to be at the end of the tunnel. Both the World Bank and the International Monetary Fund, project some stability in growth, though it is “underwhelming.” “A Great Tightening” of monetary policy of central banks of most major economies is bearing fruit in taming rampant global inflation, without precipitating a global recession, although uncertainty remains and causes policymakers to be cautiously optimistic of the future outlook and the normalisation to a more accommodative monetary policy. Against this backdrop, the quarterly SInDEx survey among a representative sample of Singapore consumers reveals Headline Inflation Expectations seem to be holding steady for half a year after gradually declining. The One-Year-Ahead MAS Core inflation expectations, which exclude volatile and policy-dependent Accommodation and Private Transportation expenses, seem to be inching down. The tight monetary policy maintained by the Monetary Authority of Singapore seems to have dampened the impact of imported inflation. However, the heightened policy uncertainty and global economic outlook seem to have marginally increased free response median inflation expectations, even after accommodating for behavioural biases in survey-based instruments (Clark, Ghosh and Hanes, 2018).” “We also observe expected changes in CPI consumption basket, opined by survey respondents, particularly on higher weighted items like Accommodation, Food, Transportation among others (Cavallo, 2020, Kouvavas et. al.,2020, Weber et. al., 2022). Some of these weights might have changed permanently, as work-from-home arrangements have become more standard, compared to the Household Economic Survey findings in 2017-2018 (HES 2017/18). We also observe a slightly higher proportion of respondents (47.3%) feel inflation is declining, and a lower proportion feels inflation is increasing (43.2%), compared to the September 2024 survey, mainly due to tight monetary policy and global slowdown,” Dr Ghosh noted. For the longer horizon, the Five-year-Ahead CPIEx inflation expectations remained unchanged in December 2024 at 4.5% compared to September 2024, remaining flat since June 2024. The current polled number continues to be slightly higher than the fourth quarter average of 4.1% polled since the survey’s inception in September 2011 up till 2023. The Five-year-Ahead CPIEx core inflation expectations (excluding costs related to Accommodation and Private Transportation) increased to 4.4% in December 2024 from 4.3% in September 2024. Overall, the composite Five-year-Ahead SInDEx5 also increased slightly to 4.5% in December 2024 from 4.3% in September 2024. In comparison, the fourth quarter average value of the composite Five-year-Ahead SInDEx5 is 3.9%, from the survey’s inception in September 2011 up till 2023. After adjusting for potential behavioural biases, the free-response Five-year-Ahead Headline Inflation Expectations remained unchanged at 5% in December 2024 compared to September 2024, while the free-response Core Five-year-Ahead Inflation Expectations increased to 5% in December 2024 from 4% in September 2024, possibly signalling heightened uncertainty. However, we observe that long-term headline inflation expectations remained constant despite global uncertainty, signalling movement towards anchoring of long-term inflation expectations. Dr Aurobindo Ghosh added, “In December 2024, SInDEx survey respondents polled long-term inflation expectations for the Five-year-Ahead Headline have stayed unchanged while the Core Inflation Expectations inched upwards from the September 2024 survey. Even after adjusting for behavioural biases, the long-term headline inflation expectations remained flat for the third quarter in a row after declining over the previous four quarters. This reflects some element of anchoring of longer-term inflation expectations, and therefore corroborates academic findings of the importance and accuracy of survey-based measures (Ang, Baekert and Wei, 2007).” Methodology DBS-SKBI SInDEx survey yields CPIEx Inflation Expectations (estimating headline inflation expectations) and related indices are products of the online quarterly survey of around 500 randomly selected individuals representing a cross section of Singaporean households. The survey is led by Principal Investigator Dr Aurobindo Ghosh, Assistant Professor of Finance (Education) at Lee Kong Chian School of Business of the SMU. The online survey, powered by Agility Research and Strategy, helps researchers understand the behavior and sentiments of decision makers in Singaporean households. DBS Group Research is a co-sponsor and research partner with the Sim Kee Boon Institute for Financial Economics (SKBI) at SMU. The quarterly DBS-SKBI SInDEx survey has also yielded two composite indices, SInDEx1 and SInDEx5. SInDEx1 and SInDEx5 measure the One-year inflation expectations and the Five-year inflation expectations, respectively. The sampling was done using a quota sample over gender, age and residency status to ensure representativeness of the sample. Employees in some sectors like journalism and marketing were excluded as that might have an effect on their responses to questions on consumption behavior and expectations. The DBS-SKBI SInDEx survey was augmented in June 2018, based on a joint research study conducted by SMU researchers in collaboration with MAS and the Behavioural Insights Team, where respondents were polled on their perceptions of components of the Consumers Price Index (CPI) and adjusted for possible behavioural biases prevalent in online surveys. Based on the recommendations of the joint study, since March 2019 the research team has polled the One-year-Ahead inflation expectations of all of the major components of CPI-All Items inflation. For December 2024 survey, DBS-SKBI CPIEx headline inflation expectations indices remained unchanged from September 2024. The core inflation expectations however inched down across different measures. The behaviourally adjusted component-wise and recombined inflation expectations increased slightly signaling some heightened uncertainty. In free-response answers, compared to September 2024 survey, responses in the December 2024 survey polled for One-year-Ahead Headline remained unchanged while Core Inflation Expectations increased. Overall, the results indicate continued slowdown in the medium term and flattening of long inflation expectations. We introduced a new ratio in the June 2020 survey, on the life versus livelihood debate as an aftermath of the Covid-19 pandemic – the ratio of respondents who feels livelihood should be prioritised over life vis-à-vis those who feel the other way. This ratio declined to 2.4 in December 2024 compared to 4 in September 2024. For every respondent who prioritised life over livelihood, there were about 2.4 who prioritised livelihood over life, signalling life returning to normal with an endemic Covid-19 in Singapore and focused on economic growth.

Figure 2: Five-year-Ahead-Inflation Expectations in Singapore: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item), DBS-SKBI CPIEx Core (excluding Accommodation and Private Road Transportation components), SInDEx (Composite index with lower weights on volatile components like Food, Energy, Accommodation and Private Transportation) One-year and Five-year-Ahead Inflation Expectations polled online quarterly for the Singapore Index of Inflation Expectations (SInDEx) Survey conducted from 16 December 2024 to 23 December 2024. The chart shows a preliminary estimate of Behaviourally Adjusted One-year-Ahead overall DBS-SKBI Adjusted CPIEx. As comparison benchmarks, the chart provides the most recent quarterly CPI-All Items Inflation, MAS Survey of Professional Forecasters median One-year-Ahead CPI-All Items inflation forecasts and the yield spread of 10-year and 1-year Singapore Savings Bonds (SSB). Source: SKBI, SMU, MAS-MTI, Department of Statistics References: Ang, A., G. Bekaert, and M. Wei., 2007, “Do Macro Variables, Asset Markets, or Surveys Forecast Inflation Better?” Journal of Monetary Economics, 54:4, pp. 1163–212. Cavallo, A., 2020, "Inflation with COVID Consumption Baskets." NBER Working Paper Series, No. 27352, June 2020 (Harvard Business School Working Paper, No. 20-124, May 2020). (https://www.hbs.edu/faculty/Pages/item.aspx?num=58253, accessed on July 14, 2020) Clark, A., A. Ghosh and S. Hanes, 2018, “Inflation Expectations In Singapore: A Behavioural Approach,” Macroeconomic Review, Vol 17:1, pp. 89-98. Household Expenditure Survey (HES 2017/18): (https://www.singstat.gov.sg/publications/households/household-expenditure-survey, accessed on July 10, 2024) Kouvavas, O., R. Trezzi, M. Eiglsperger, B. Goldhammer and E. Goncalves, 2020, “Consumption patterns and inflation measurement issues during the COVID-19 pandemic,” ECB Economic Bulletin, Issue 7/2020. (https://www.ecb.europa.eu/pub/economic-bulletin/html/eb202007.en.html#toc6, accessed on July 14, 2020) MAS Monetary Policy Statement- October 2024, (https://www.mas.gov.sg/news/monetary-policy-statements/2024/mas-monetary-policy-statement-14oct24, accessed on Oct 17 2024) MAS Survey of Professional Forecasters (MAS SPF), December 2024, (https://www.mas.gov.sg/-/media/mas-media-library/monetary-policy/mas-survey-of-professional-forecasters/2024/survey-writeup-dec-2024-web.pdf, accessed on Jan 16, 2025) Singapore Consumer Price Index Press Release (DOS CPI), December 2024, Singapore Department of Statistics (https://www.singstat.gov.sg/-/media/files/news/cpinov24.ashx, accessed on January 16, 2024) Weber, M., F. D’Acunto, Y. Gorodnichenko and O. Coibion, 2022, “The Subjective Inflation Expectations of Households and Firms: Measurement, Determinants, and Implications,” Journal of Economic Perspectives, 36:3, pp. 157–184. SUBSCRIBE TO THE SKBI MAILING LIST*Get updates on SKBI news and forthcoming events. *Please note that upon providing your consent to receive marketing communications from SMU SKBI, you may withdraw your consent, at any point in time, by sending your request to skbi_enquiries [at] smu.edu.sg (subject: Withdrawal%20consent%20to%20receive%20marketing%20communications%20from%20SMU) . Upon receipt of your withdrawal request, you will cease receiving any marketing communications from SMU SKBI, within 30 (thirty) days of such a request. |

Singapore residents expect a slight increase in expenses over the next 12 months, according to the quarterly Singapore Index of Inflation Expectations (SInDEx) survey by SMU and DBS Group Research. The 54th edition survey shows one-year-ahead headline inflation expectations stayed at 3.8 per cent from September 2024 to December 2024. About 500 individuals representing various Singaporean households were surveyed. DBS co-sponsors the research with SMU’s Sim Kee Boon Institute for Financial Economics (SKBI). SMU Assistant Professor Aurobindo Ghosh noted that recovery from the pandemic has cemented some lifestyle changes, potentially affecting the cost of living.