Inflation Expectations in Perspective

Research Notes (April 2019)Globally, central banks track different measures of inflation expectations to better understand the behavior of current and future inflation. Although inflation expectations are hard to derive and measure, economists usually attempt to tease out the relevant information from surveys, models or market-based indicators.

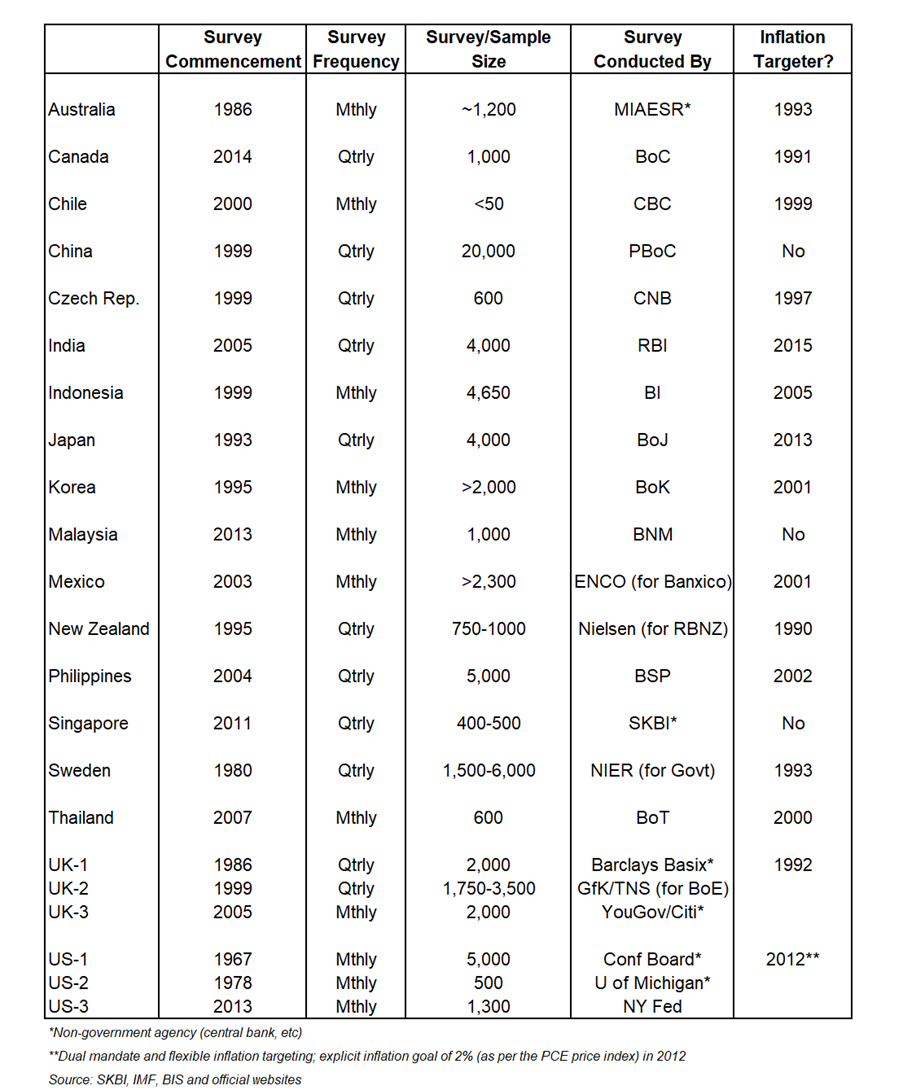

The household or consumer survey measures of inflation expectations (refer to the accompanying table) tend to have fairly long histories. Although the majority of household surveys--especially in Asia--have been conducted or commissioned by central banks or government agencies, the earliest surveys in advanced economies were actually produced by the private sector, for example in the US (1967) and UK (1986).

Similarly, the household surveys in Singapore and Australia--by Singapore Management University’s Sim Kee Boon Institute and Melbourne Institute, respectively--were also initiated privately. Hence, on a global basis, an uneven mix of government and non-government organizations produce inflation expectations measures from household surveys.

Central banks, either explicit or implicit inflation targeters, harness the information garnered from surveys for varied reasons and with differing timelines. For example, the Melbourne Institute started surveying consumers on a monthly-basis surrounding expectations of price changes since 1986 (on a quarterly-basis from mid-1970s, then on a monthly frequency starting in 1986), but the Reserve Bank of Australia did not officially adopt inflation targeting until 1993, roughly three years after New Zealand, which was the first country to commence formal inflation targeting.

Also, household measures of inflation expectations were collected way before inflation targeting became a reality in Japan, Korea and India. On the contrary, the inflation-targeting framework in Thailand and Philippines came into existence prior to the launch of the inflation expectations surveys. But within the ASEAN-5, Indonesia was the earliest user of household surveys, which commenced in 1999, preceding the formal adoption of inflation targeting in 2005. The central banks in Malaysia and Singapore, which are not formal inflation targeters, appeared slower in promoting the use of household survey measures of inflation expectations.

Broadly, consumers view inflation expectations as crucial inputs to the decision making process, for instance, when evaluating durable good purchases, longer-term investments, employment prospects, saving decisions and so on. But gauging the likely impact of inflation expectations on consumer spending is not straightforward. Although some studies show mixed results, with the spending response contingent on whether or not the income or substitution effect dominates, other studies find that higher inflation expectations, especially in the presence of an effective lower bound rate environment, tend to be associated with greater consumption growth. Similarly, firms take into account the relevant details on inflation expectations, harnessing the information as a guide for undertaking investment decisions, longer-term business planning, price setting behaviour, labor market hiring, etc.

Generally, the information collected from household surveys can be useful for gauging the credibility of central banks and offering a different perspective on the economy. Research indicates that the majority of central banks, especially from advanced economies, appear to utilize inflation expectations data from surveys mainly for effective communication with the public.

Some studies find that inflation targeting central banks tend to prefer inflation expectations extracted from surveys of “economic agents” (households, businesses or firms, etc) over inflation-indexed bonds and professional forecaster surveys. While household surveys can be too heterogeneous (individual responses vary extensively) and exhibit one-sided measurement errors (overestimation of expected inflation), households overall exert a crucial influence on the broader economy. Although surveys of firms--arguably more relevant partly because of the price and wage determination process--can probably provide better insights on inflation expectations, there are data availability and measurement issues.

Available research, however, suggests that inflation expectations from surveys of professional forecasters are usually more accurate and reveal less bias in predicting future inflation than household surveys. Nevertheless, studies indicate that the responses of households, firms and professional forecasters tend to be sensitive to different factors, implying that it is crucial to examine the inflation expectations data of different groups.

While the market-based measures of inflation compensation derived from index-linked bonds or swap contracts are timelier gauges of inflation expectations, the embedded risk premia and other idiosyncratic factors could distort the informational content of these indicators.

Overall, because inflation expectations from the different sources are neither directly observable nor fungible, a deeper investigation of the advantages and drawbacks of the various measures is needed. Also, a better and more complete understanding of expectations formation, against the backdrop of low neutral interest rates globally, may potentially enhance and elevate the role of using inflation expectations for monetary policy stabilization.

“Household” & “Individual” Surveys of Inflation Expectations

References

Adeney, R., Arsov, I., & Evans, R. (2017). Inflation Expectations in Advanced Economies RBA Bulletin, Reserve Bank of Australia, 31-44.

Ang, A., Bakaert, G., & Wei, M. (2007). Do Macro Variables, Asset Markets or Surveys Forecast Inflation Better? Journal of Monetary Economics, 54, 1163-1212.

Berge, T. (2017). Understanding Survey Based Inflation Expectations International Journal of Forecasting, vol. 34, no.4, 788-801.

Bryan, M.F., Meyer, B.H., & Parker, N.P. (2014). The Inflation Expectations of Firms: What Do They Look Like, are They Accurate, and Do They Matter? Federal Reserve Bank of Atlanta, Working Paper No. 2014-27a

Burke, M.A., & Ozdagli, A. (2013). Household Inflation Expectations and Consumer Spending: Evidence from Panel Data Federal Reserve Bank of Boston Working Paper Series No 13-25

Faust, J., & Wright, J.H. (2013). Forecasting Inflation in Elliot and Timmermann (edt.), Handbook of Economic Forecasting, Elsevier

Lyziak, T. (2010). Measurement of Perceived and Expected Inflation on the Basis of Consumer Survey Data IFC Working Papers, No 5

Mishkin, F. (2007). Inflation Dynamics NBER Working Paper 13147

Rowe, J. (2016). How Are Households’ Inflation Expectations Formed? Bank of England Quarterly Bulletin, vol. 56(2), 82-86

Sousa, R., & Yetman, J. (2016). Inflation Expectations and Monetary Policy BIS Paper 89d, Bank for International Settlements, Basel, Switzerland