These are the research findings of the 51st round of the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey at the Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University (SMU).

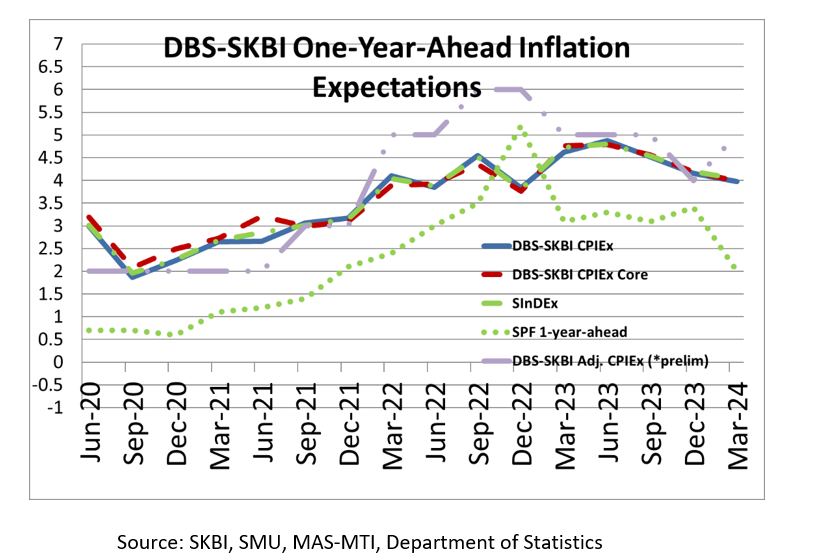

- One-year-Ahead headline inflation expectations pared to 4.0% in March 2024 from 4.2% in December 2023. Consumers’ inflation expectations continued their downward trend, albeit at a slightly slower pace responding to headwinds to global growth punctuated by supply chain disruptions, ongoing conflicts in Ukraine and the Middle East, and a remarkably resilient US economy. Nonetheless, the first quarter One-year-Ahead inflation expectations continue to be higher than the average One-year-Ahead headline inflation expectations of 3.6% since the inception of this Index in the third quarter of 2011.

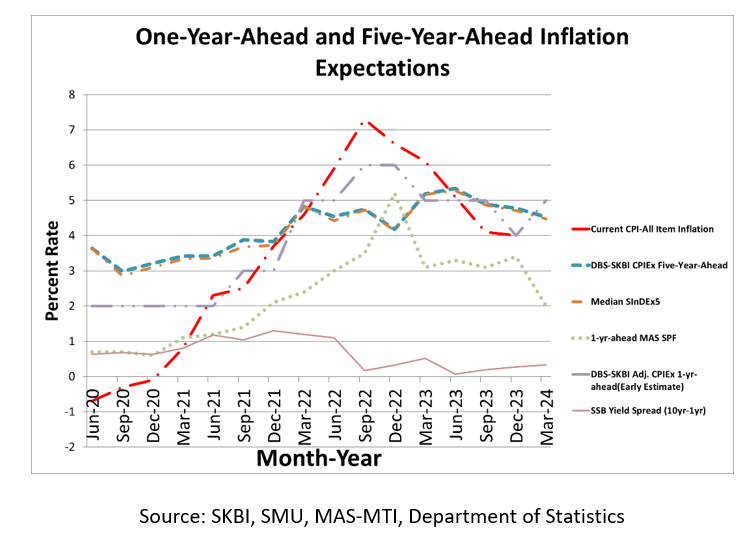

- As a comparison benchmark, data from the Monetary Authority of Singapore Survey of Professional Forecasters (MAS SPF) released in March 2024 showed that the median forecast of the Consumer Price Index (CPI)-All Items inflation for 2024 was 3.1% (for 2025, 2.0%) while MAS Core Inflation median forecast was 3.0% (for 2024, 2.0%) (MAS SPF March 2024, Table 2 and Table A.6). The latest CPI data release from the Department of Statistics showed that CPI-All Items rose by 3.1% between January and February 2024, compared to the same period in 2023, with the latest February 2024 monthly inflation print coming in at 3.4% year-on-year. On 12 April 2024, in their second quarterly policy review in 2024, MAS maintained the rate of appreciation of the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy band, following five consecutive tightening moves between October 2021 and October 2022. The current appreciating path of the S$NEER policy band is intended to continue to reduce imported inflation and help curb domestic cost pressures, thereby ensuring medium-term price stability. The next monetary policy statement will be announced in July 2024.

- The overall Consumer Price Index (CPI) Inflation Expectations (CPIEx), after adjusting for potential component-wise behavioural biases and re-combining across components, increased to 4.9% in March 2024 from 4.8% in December 2023. One-year-Ahead inflation expectations of major components of CPI like Food (at 5%), Transportation (at 5%), Housing & Utilities (at 5%), Healthcare (at 5%) and Miscellaneous Goods and Services including Personal Care stayed unchanged at 5% while other components like Household Durables and Services, Clothing & Footwear, Communications also stayed unchanged at 4% compared to the December 2023 readings. Other components like Education increased from 4% to 5% while Recreation & Culture also increased from 4.2% to 5%, between December 2023 to March 2024 surveys. Despite a more uncertain geopolitical and socio-economic environment, higher demand related to Travel, Services, Food & Beverage and Accommodation might have been met with a commensurate increase in supply, which led to mostly flattening of inflation expectations across the board, except for Education and Recreation & Culture, possibly because Singapore is becoming a more attractive place for concerts and MICE events.

- The survey team also polled free-response overall inflation expectations after accommodating potential behavioural biases by informing respondents of current data. We found that the One-year-Ahead headline inflation expectations stayed unchanged at 5% while the inflation expectations, after stripping out Accommodation and Private Transportation, also remained unchanged at 5% between the surveys in December 2023 and March 2024. These free-response polls help us to gauge perceptions of anchoring of inflation expectations and consumer sentiments in an aggregated sense.

- In the March 2024 survey, continuing for the last eight quarters since June 2022, we took a more forward-looking approach in analysing the impact of global economic developments on Singapore’s economic growth and inflation.

- Overall, given the uncertain global geopolitical and socio-economic outlook, in conjunction with strategic tensions between the world’s largest two economies, and potentially “higher for longer” global interest rates, Singaporean consumers expect a slight negative impact on the country’s economic growth over the next 12 months.

- Given general cost-of-living pressures Singaporean consumers also opined that over the next 12 months, their overall expenses are expected to increase slightly.

- In the March 2024 survey, Singaporean consumers polled were equally split on how they felt the overall One-year-Ahead inflation scenario would unfold in the next 12 months. Around 45.9% (compared to 48.6% in December 2023) of those surveyed expect inflation to decline in the medium term of one year ahead while 45.9% (compared to 42.2% in December 2023) felt that One-year-Ahead inflation will increase. This remarkable result illustrates the cognitive dissonance coming from the high level of uncertainty that is plaguing the global economy.

- The main reason cited by those expecting inflation to decline is the slowdown of global growth (36%). The increase in interest rates by major central banks was cited by 28% and this is the second most common reason given. A not-too-distant third, given by 22.8% of respondents, was that the resolution of supply chain disruptions is also expected to relieve price pressures. Among respondents expecting inflation to increase over the next 12 months, the most common reasons cited were equally split between geopolitical uncertainties due to the conflicts between Ukraine and Russia and Hamas and Israel, and central banks raising and keeping interest rates high (both 24.1%), followed by fiscal responsibility measures such as the hike in GST (16.8%). Among respondents expecting price levels to increase, 15.9% blamed supply chain disruptions while only 13.4% cited higher demand due to relaxation of pandemic era measures like resurgent business and personal travel needs.

- In the March 2024 survey, respondents opined that current economic conditions have a limited negative impact on One-year-Ahead and Five-year-Ahead overall inflation expectations, although as mentioned before, there is significant variation of perspectives or behavioral bias among the respondents, which results in a bimodal distribution with one segment of the population expecting a decline in inflation while another expecting an increase in inflation. Component-wise, respondents expect a slight negative impact on inflation related to Food, Transportation, and Housing & Utilities, while there was no such discernible negative impact on Healthcare, Education, Household Durables & Services, Recreation & Culture, Communications, Clothing & Footwear and Miscellaneous Goods & Services.

- Alberto Cavallo of Harvard Business School (Cavallo, 2020) and a report by the European Central Bank (Kouvavas et al., 2020) highlighted potential biases in CPI calculations with fixed baskets as respondents made substantive changes to their consumption baskets owing mainly to the COVID-19 pandemic. In the March 2024 survey, Singaporean consumers polled that in the next 12 months they expect no change in budget share of expenses for Education Recreation & Culture, Communications, Clothing & Footwear, and Miscellaneous Goods & Services. However, the respondents expect a slight increase in the budget share of expenses in Food, Transportation, Housing & Utilities, Healthcare and Household Durables & Services. These results indicate that respondents expect their consumption baskets to change over the next 12 months. This means some respondents expect a higher proportion of budget or higher budget share on certain components over the next 12 months, compared to other components. These changes in budget share can potentially be due to more permanent changes in consumption behaviour in the post-pandemic era, like the practice of working from home regularly or ordering groceries online rather than buying them in-store.

- Excluding inflation expectations in Accommodation and Private Transportation, the One-year-Ahead CPIEx core inflation expectations for this SInDEx survey dropped to 4.0% in March 2024 compared to 4.2% in December 2023. This signalled the decline in overall inflation was broad-based and was not entirely driven just by the more volatile changes in Accommodation or Private Transportation.

- For a subgroup of the population who owns their accommodation and uses public transport, the One-year-Ahead CPIEx core inflation expectations declined from 4.2% in December 2023 to 3.9% in March 2024, consistent with the overall decline in inflation expectations – verifying the robustness of the findings. This sub-sample measurement is potentially more representative and hence more accurate than the full sample measurement, due to high home ownership and public transport ridership in Singapore.

- Unlike the fixed radio button response which might be susceptible to various behavioural biases, core CPIEx Inflation Expectations (excluding Accommodation and Private Transportation expenses), after adjusting for potential component-wise behavioural biases and re-combining across components, inched up to 4.8% in March 2024 from 4.6% in the December 2023 survey. The free-response core CPIEx Inflation Expectations, however, stayed unchanged in March 2024 at 5% as in the December 2023 survey. The variation between these cognitive measures of perception of inflation expectations addresses that even though there might be some changes in price levels, individual households often adapt to current conditions and update their baskets accordingly. So oftentimes fixed basket calculations like CPI can give us potentially higher inflation figures, therefore a more reflective measure might be the core per capita consumption expenditure (core PCE) typically used by central banks like the Federal Reserve Board.

- The One-year-Ahead composite index SInDEx1 that puts less weight on more volatile components like Accommodation, Private Road Transport, Food and Energy-related expenses polled dropped to 4.0% in March 2024 from 4.2% in December 2023. It continued to be higher than the first quarter average of 3.5% during the survey’s existence from 2011 - 2023.

- In addition, in March 2024, 7.8% of Singaporeans polled expect a more than 5.0% reduction in salary in the next 12 months, same as in the December 2023 survey, so no discernable decline in the job outlook was detected. The median salary increment expectation of a 1.0% to 5.0% increase also remained unchanged compared to the December 2023 survey.

Figure 1: One-year-Ahead inflation expectations: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding Accommodation and Private Road Transportation components) One-year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDEx) Survey conducted on a representative sample of Singaporean residents between 18 March and 25 March 2024.

DBS Bank Chief Economist and Managing Director of Group Research, Dr Taimur Baig commented, “Inflation has eased over the past year, but not to the extent of giving policymakers the comfort to ease monetary policy. This is a largely global phenomenon, and for Singapore, it is no exception. Expectations are adjusting to this reality of above-trend inflation. At the same time, neither inflation nor inflation expectations are at levels to cause concern about additional tightening in the horizon.”

Dr Aurobindo Ghosh, Assistant Professor of Finance at Singapore Management University (SMU), the creator and the founding Principal Investigator of the Quarterly DBS-SKBI SInDEx Project, observed, “The widely followed US nationally representative Survey of Consumer Expectations (SCE) conducted by the New York Federal Reserve have observed in April 2024, a divergence in medium (One-year-Ahead) term inflation expectations, which stayed pat at 3% last three months, while the long term inflation expectations (5-year-ahead) have slightly declined (SCE, 2024). This signals singular uncertainty among US consumers where the recent US job reports are showing remarkable resilience, and the April 2024 Consumer Price Index (CPI) inflation print is turning out to be incredibly persistent. This has deflated the market perception of multiple rate cuts from US Federal Reserve starting in June 2024. With this backdrop, in the DBS-SKBI Survey of Inflation Expectations (SInDEx), which was initiated in 2011 before the New York Fed Survey of Consumer Expenditures (SCE), respondents opined that the One-Year-Ahead inflation expectations have moderated downwards slightly across the board both for the CPI All-Item Headline inflation expectations as well as the less volatile Core Inflation Expectations which strips out Accommodation and Private Road Transportation expenses. These results are in conjunction with the behaviorally accommodated free response measures proposed by Clark, Ghosh, and Hanes (2018), for overall headline and core inflation expectations, which also recorded stickiness in inflation expectations over the last three quarters.”

“Besides the uncertainty in perception corroborated by the New York Fed’s SCE, the one remarkable aspect that comes out of the analysis is that individual respondents seem to be adjusting their consumption basket in response to the differential cost pressures arising out of geopolitical uncertainty and differential expectations of the future (Cavallo, 2020, Kouvavas et. al.,2020, Weber et. al., 2022). In addition, to reflect a level of cognitive dissonance, we find an equal split of respondents who opine one-year ahead inflation rate will go down (owing to a slowdown of global growth) and those who polled that one-year ahead inflation would go up (due partly to conflicts and ‘higher for longer’ interest rate policy stance of major Central banks like the US Federal Reserve Board). Hence, it is not surprising that the Monetary Authority of Singapore have kept their tight policy stance unchanged in their April 2024 Monetary Policy Review, while they closely monitor global and domestic economic developments as stated in MAS Monetary Policy Statement of April 2024,” Dr Ghosh observed.

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations declined from 4.8% in December 2023 to 4.5% in March 2024. The current polled number continues to be slightly higher than the first quarter average of 4.3% polled since the survey’s inception in September 2011 up till 2023.

The Five-year-Ahead CPIEx core inflation expectations (excluding costs related to Accommodation and Private Road Transportation) also dipped to 4.5% in March 2024 from 4.7% in December 2023. Overall, the composite Five-year-Ahead SInDEx5 also reduced slightly to 4.5% in March 2024 from 4.7% in December 2023. In comparison, the first quarter average value of the composite Five-year-Ahead SInDEx5 is 4,1%, since the survey’s inception in September 2011 up till 2023.

After adjusting for potential behavioural biases, the free-response Five-year-Ahead Headline Inflation Expectations remained unchanged at 5% in March 2024 from December 2023, while the free-response Core Five-year-Ahead Inflation Expectations also remained unchanged in March at 5% compared to December 2023. This might reflect that slower global growth prospects are counteracting potential of higher inflation due to geopolitical conflicts and higher cost of living despite relatively high interest rates in major economies.

Dr Aurobindo Ghosh said, “DBS-SKBI SInDEx survey respondents polled a decline in the long-term inflation expectations both for the Five-Year-Ahead Headline as well as the Core Inflation Expectations continuing a trend that started in June 2023. Even after adjusting for behavioural biases, the long-term inflation expectations seem remarkably sticky (declining slightly or remaining flat) over the last four quarters. While this corroborates the findings by New York Fed’s SCE (SCE, 2024) in the US, this also reflects informed opinion among Singaporean consumers who observe that uncertainty in the short term will reduce in the longer term. They are looking past short-term fluctuations in fiscal measures like the planned GST increase or geopolitical or strategic conflicts – a hallmark of anchoring of long-term inflation expectations.”

References:

Ang, A., G. Bekaert, and M. Wei., 2007, “Do Macro Variables, Asset Markets, or Surveys Forecast Inflation Better?” Journal of Monetary Economics, 54:4, pp. 1163–212.

Cavallo, A., 2020, "Inflation with COVID Consumption Baskets." NBER Working Paper Series, No. 27352, June 2020 (Harvard Business School Working Paper, No. 20-124, May 2020). (https://www.hbs.edu/faculty/Pages/item.aspx?num=58253, accessed on July 14, 2020)

Clark, A., A. Ghosh and S. Hanes, 2018, “Inflation Expectations In Singapore: A Behavioural Approach,” Macroeconomic Review, Vol 17:1, pp. 89-98.

Kouvavas, O., R. Trezzi, M. Eiglsperger, B. Goldhammer and E. Goncalves, 2020, “Consumption patterns and inflation measurement issues during the COVID-19 pandemic,” ECB Economic Bulletin, Issue 7/2020. (https://www.ecb.europa.eu/pub/economic-bulletin/html/eb202007.en.html#toc6, accessed on July 14, 2020)

MAS Monetary Policy Statement- April 2024, (https://www.mas.gov.sg/news/monetary-policy-statements/2024/mas-monetary-policy-statement-12apr24, accessed on April 12, 2024)

MAS Survey of Professional Forecasters (MAS SPF), March 2024, (https://www.mas.gov.sg/-/media/mas-media-library/monetary-policy/mas-survey-of-professional-forecasters/2024/survey-writeup-mar-2024-web.pdf, accessed on Apr 12, 2024)

Survey of Consumer Expenditure (SCE), 2024, “Inflation Expectations are Mixed; Consumers Express Concerns about Retaining and Finding Jobs,” (Press Release on April 8, 2024), (https://www.newyorkfed.org/newsevents/news/research/2024/20240408, accessed on Apr 12, 2024).

Weber, M., F. D’Acunto, Y. Gorodnichenko and O. Coibion, 2022, “The Subjective Inflation Expectations of Households and Firms: Measurement, Determinants, and Implications,” Journal of Economic Perspectives, 36:3, pp. 157–184.

Methodology

DBS-SKBI SInDEx survey yields CPIEx Inflation Expectations (estimating headline inflation expectations) and related indices are products of the online quarterly survey of around 500 randomly selected individuals representing a cross section of Singaporean households. The survey is led by Principal Investigator Dr Aurobindo Ghosh, Assistant Professor of Finance (Education) at Lee Kong Chian School of Business of the Singapore management University. The online survey, powered by Agility Research and Strategy, helps researchers understand the behavior and sentiments of decision makers in Singaporean households. DBS Group Research is a co-sponsor and research partner with the Sim Kee Boon Institute for Financial Economics (SKBI) at SMU.

The quarterly DBS-SKBI SInDEx survey has also yielded two composite indices, SInDEx1 and SInDEx5. SInDEx1 and SInDEx5 measure the One-year inflation expectations and the Five-year inflation expectations, respectively. The sampling was done using a quota sample over gender, age and residency status to ensure representativeness of the sample. Employees in some sectors like journalism and marketing were excluded as that might have an effect on their responses to questions on consumption behavior and expectations.

The DBS-SKBI SInDEx survey was augmented in June 2018, based on a joint research study conducted by SMU researchers in collaboration with MAS and the Behavioural Insights Team, where respondents were polled on their perceptions of components of the Consumers Price Index (CPI) and adjusted for possible behavioural biases prevalent in online surveys.

Based on the recommendations of the joint study, since March 2019 the research team has polled the One-year-Ahead inflation expectations of all of the major components of CPI-All Items inflation. For March 2024 survey, DBS-SKBI CPIEx headline inflation expectations indices declined compared to December 2023. The core inflation expectations also declined similarly. However, the behaviourally adjusted component-wise and recombined inflation expectations increased slightly, although the overall behaviourally adjusted indices stayed unchanged almost across the board except for education and recreation & culture which increased marginally. In free-response answers, compared to December 2023 survey, responses in the March survey polled for One-year-Ahead Headline declined and Core Inflation Expectations remained unchanged, signalling some levels of anchoring. Overall, the results indicate a slowdown and flattening of the trend of medium and long inflation expectations.

We introduced a new ratio in the June 2020 survey, on the life versus livelihood debate as an aftermath of the Covid-19 pandemic – the ratio of respondents who feels livelihood should be prioritised over life vis-à-vis those who feel the other way. This ratio increased to about 4.7 in March 2024 (its highest level since inception) from 2.6 in December 2023. For every respondent who prioritised life over livelihood, there were about 5 who prioritised livelihood over life, signalling life returning to normal with an endemic Covid-19 in Singapore and focus has shifted to growth.

Figure 2: Five-year-Ahead-Inflation Expectations in Singapore: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item), DBS-SKBI CPIEx Core (excluding Accommodation and Private Road Transportation components), SInDEx (Composite index with lower weights on volatile components like Food, Energy, Accommodation and Private Road Transportation) One-year and Five-year-Ahead Inflation Expectations polled online quarterly for the Singapore Index of Inflation Expectations (SInDex) Survey conducted from 18 March 2024 to 25 March 2024. The chart shows a preliminary estimate of Behaviourally Adjusted One-year-Ahead overall DBS-SKBI Adjusted CPIEx. As comparison benchmarks, the chart provides the most recent quarterly CPI-All Items Inflation, MAS Survey of Professional Forecasters median One-year-Ahead CPI-All Items inflation forecasts and the yield spread of 10-year and 1-year Singapore Savings Bonds (SSB).

SUBSCRIBE TO THE SKBI MAILING LIST*

Be alerted on SKBI news and forthcoming events.

*Please note that upon providing your consent to receive marketing communications from SMU SKBI, you may withdraw your consent, at any point in time, by sending your request to skbi_enquiries [at] smu.edu.sg (subject: Withdrawal%20consent%20to%20receive%20marketing%20communications%20from%20SMU) . Upon receipt of your withdrawal request, you will cease receiving any marketing communications from SMU SKBI, within 30 (thirty) days of such a request.